When you initiate looking around to own mortgages as part of the property process, it is necessary that you know just how much you’ll be able to borrow purchasing property.

For Virtual assistant loan consumers, this may feel like kind of a complicated https://paydayloansconnecticut.com/southport/ process. Based on your certification out-of qualifications (COE), you’ve got a certain amount of entitlement, but what just does that mean? Does your own Virtual assistant entitlement count limit how much you can use?

What exactly is Virtual assistant Mortgage Entitlement?

Virtual assistant loan entitlement is the amount brand new Institution from Experts Affairs will make sure towards confirmed borrower’s Va financing. Quite simply, this is the restrict count the Va have a tendency to pay off the lender in the event that you standard on your mortgage.

How much does this suggest to have individuals? One of many great benefits of going a beneficial Va loan, and you may specific most other non-conforming funds, is you don’t have to create an advance payment. Your Va entitlement count informs you the maximum amount you might use in place of to make a down-payment.

At the time of , Va financing individuals which have complete entitlement do not have a limit to the how much they could obtain having an effective 0% deposit. For those consumers, new Virtual assistant will guarantee up to twenty-five% of your own amount borrowed into the money of every dimensions.

Full Entitlement

If you have never acquired good Va mortgage ahead of or you have paid down from a past Virtual assistant mortgage in full and you can offered the property the borrowed funds was utilized to acquire, you’ll have complete entitlement.

When you have full entitlement, you don’t need a limit about how exactly far you can obtain in the place of and also make a down payment. The fresh new Va will make sure as much as twenty-five% of your amount borrowed, even in the event they exceeds the conforming financing limitation for the condition.

But not, that doesn’t mean you could borrow an endless amount of money; you might just borrow doing a loan provider have a tendency to be considered your to have. Your own lender will look at your income, debts and credit history to decide exactly how much they truly are prepared to provide your.

Less Entitlement

If your entitlement matter try faster, you officially plus lack a threshold to help you how much you is also borrow, but when you exceed the entitlement, you are going to need to generate an advance payment.

Your entitlement tends to be smaller for individuals who now have a good Virtual assistant financing that you’re still paying back, has actually paid back your loan completely but still very own the home your utilized the mortgage to acquire, or you defaulted with the a previous Virtual assistant financing.

If your entitlement are quicker, the fresh Va will only ensure the loan up to the fresh compliant financing limitation, without the entitlement you will be already playing with. We will discuss exactly how to find out your own reduced entitlement count subsequent off.

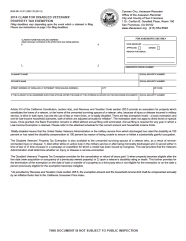

Certification Regarding Qualification (COE) And you can Va Entitlement Codes

The latest COE ‘s the file appearing that productive-obligation solution players and you will pros meet with the solution requirements getting entitled to a beneficial Virtual assistant home loan. It’s going to and incorporate facts about the entitlement number.

Your own COE will get an enthusiastic entitlement password listed on it. All of these requirements keep in touch with specific wartime otherwise peacetime periods and you will imply the way you received your entitlement.

If you have in past times removed an effective Virtual assistant financing, their entitlement password might be detailed since 05. Thus you’ve used your own Virtual assistant financial positives ahead of and your entitlement has been restored, enabling you to pull out several other Virtual assistant loan.

If you don’t have good COE, no sweating your financial normally typically get that it to you personally once you have been the borrowed funds application techniques. You can also submit an application for your own COE on the internet from the VA’s eBenefits website.

Variety of Va Loan Entitlement

The COE will tell you simply how much basic entitlement you have. However, additionally, you will have in all probability an extra entitlement used, both named incentive otherwise Tier dos entitlement.

The concept of earliest entitlement and you can incentive entitlement shall be an excellent absolutely nothing complicated, however, borrowers generally won’t have to worry about these terms and conditions as well far. Listed here is a little primer within these 2 kinds of entitlement and you may how they performs.

Very first Entitlement

It is critical to keep in mind that this is simply not a threshold on how much you could borrow or simply how much the latest Virtual assistant tend to ensure. All this function is that to your loans around $144,000, the newest Va will guarantee around $thirty-six,100 25% of one’s amount borrowed.

That does not mean you will be limited to financing doing $144,000. After you have used up the very first entitlement, your extra entitlement kicks when you look at the.

Incentive Entitlement

Extra entitlement is exactly what you may have to the funds more $144,one hundred thousand. If you have full entitlement, the fresh new Va will make sure around twenty five% of loan amount.

If you have faster entitlement, new Virtual assistant only guarantee as much as twenty-five% of your county’s conforming loan limitation, without amount of entitlement you may be currently using.

If your COE claims that the entitlement is $0, that does not mean you simply can’t rating that loan. It simply ensures that any $thirty-six,100 first entitlement is currently being used. You may still has incentive entitlement available.

If you have made use of your first entitlement, how can you work out how far added bonus entitlement you really have? You will have to do some bit of mathematics. Why don’t we talk about ideas on how to compute this.