A secondary house is a property except that your primary home that you use having recreation. Travel belongings typically have some other financial support requirements than simply often your primary domestic otherwise an investment property. For many who earn one local rental earnings on the travel domestic, you’ll also should be alert to the principles one to control how one earnings is actually taxed.

Why don’t we take a closer look at the vacation home, how you might use one, and you can if or not to get this type of second house is an effective tip for you.

Meaning and you will Examples of Vacation Belongings

The phrase a secondary home may sound very obvious: It’s an extra property your folks and you see occasionally and you can normally fool around with to have recreation. But not, it is far from as simple as only becoming an additional home. How frequently you utilize it, whether you book it out, and also how long out it is from your number one home get most of the connect with your property’s reputation as a secondary household.

- Alternative names: vacation assets, 2nd household, secondary household

Just how Travel Home Really works

Whenever you are owning a vacation house may appear enticing, it is very important take into account the products which make this kind of assets different from other kinds of home.

Such, you can normally you prefer more substantial downpayment for a holiday household than you would to possess a first home-basically at least ten%. you will have to satisfy a number of important standards basically required by lenders:

- You ought to inhabit our home to own area loans Millport of the seasons.

- It ought to be a one-product hold.

- The property have to be available season-bullet, and should not an effective timeshare otherwise fractional ownership property.

- The house shouldn’t be work from the a rental otherwise property administration company.

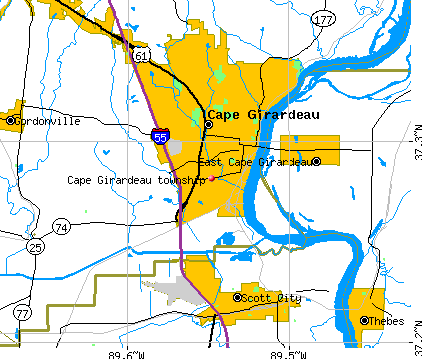

Some loan providers additionally require a holiday property be located at least point from your priple, your trip home could need to become no less than fifty kilometers out of your head home.

If you intend so you’re able to rent your vacation household if you find yourself not using it, you will need to think potential income tax effects. The brand new Irs is served by rigorous rules when it comes to just what qualifies just like the a holiday possessions. A secondary home qualifies due to the fact a residence for many who check out it private use on the greater from 2 weeks or 10% of the time your lease it (including, at the very least 20 days if it’s leased aside to own 200 days a-year).

If you rent your vacation home getting fewer than 15 months a year, it’s not necessary to statement the amount of money you have made. Although not, you might not manage to deduct any costs, such as for instance home loan appeal or property taxes, while the local rental expenditures.

Trips Domestic against. Money spent

Before buying a vacation home, it is vital to comprehend the differences between trips home and you may money properties. The biggest factor is whether or not you intend in order to rent their travel property when you are not using they, just in case so, how frequently.

Such as for instance, the rate you will get in your mortgage get count on how the financial viewpoints your house. Whether it qualifies while the a vacation domestic instead of an investment assets, you happen to be eligible for down interest levels. You may have to invest in more bank conditions, instance agreeing the house will not be rented out for over 180 months a-year.

Internal revenue service laws do not require you to definitely statement unexpected leasing money away from your vacation home, as long as they qualifies due to the fact a personal home therefore rent it out for under fifteen months a year. not, money spent local rental income have to be included on the income tax come back. The main benefit is the fact you will be able to subtract local rental expenses eg fix, utilities, and you will insurance coverage.

Was a secondary House Worthwhile to you personally?

Determining whether or not a vacation home is a good fit for your family are your own decision. There are lots of activities where to find a vacation house is a good idea for your requirements, particularly when you’re looking to make a good investment. Like many a residential property, travel home have the opportunity to build equity. You may want to have the ability to rent out your vacation domestic while staying away from they, that will carry out a pleasant income load.

not, you will want to consider how frequently possible visit your trips domestic. Since many lenders will want your trip the place to find be found a good distance away from your top home, you’ll want to cause of take a trip some time and costs, particularly if the journey requires plane take a trip. Failing woefully to invest a lot of time at your travel home and you can renting it usually might actually turn your vacation domestic towards a keen investment property, which can affect your own taxation.

2nd property also come with an increase of will set you back, along with mortgage loans, possessions taxes, insurance policies, and you can restoration expenditures. Consider these expenditures before buying to see if a vacation home will squeeze into your allowance.