Because mortgage costs lose, some one might possibly be inclined to research rates to have a far greater bargain. Or perhaps he’s got have been in some cash and would like to pay back their fixed-rates loan early.

But potential attract deals could be counterbalance by the more substantial upfront cost: A beneficial prepayment prices, also referred to as a rest commission.

All banking companies use in the wholesale sell to finance home loans. Some slack percentage covers the costs obtain because of the bank whenever a consumer ends up a binding agreement early.

It is not easy knowing ahead exactly how much these types of charges costs, as they confidence most recent wholesale cost, on top of other things.

Why now?

Always, split costs only become difficulty whenever interest levels is falling, told you Christopher Walsh, the latest inventor off financial degree business, MoneyHub.

«Maybe this past year, when interest levels left growing, it preferred an effective four-season offer. Now, it see mass media retailers reporting rates are shedding. For similar unit, they think they have been investing an excessive amount of.»

In recent months, major banks have been cutting house interest rates. So it adopted drops during the wholesale costs, predicated on criterion one central banks are becoming nearer to cutting its standard cost.

Cost fell again at the end of March, pursuing the Reserve Lender established it had been staying the official Cash Rates during the 5.5 per cent. And you can once again, for the Tuesday, having ASB and you can Kiwibank.

Records

The OCR strike an extended-term reduced out of 0.25 % when you look at the . However the mediocre home loan prices don’t base aside until regarding eighteen months later.

As to why? New OCR has an effect on the expense of borrowing for lenders. Increasing they reduces discretionary purchasing, air conditioning new economy. Minimizing it can make they lesser to help you borrow cash, producing investing. Typically, in the event that OCR goes up, mortgages perform, as well — and you can vice versa.

Returning to : The common domestic financial interest getting a two-season package is cuatro.twenty-two per cent. The following year, it had been step three.47 per cent. Into the 2022, it had been 5.04 percent. And you can just last year, eight.03 per cent. Into the March this season, it actually was eight.45 per cent.

Toward Saturday, Kiwibank launched for family individuals that have at the least 20 percent collateral, the new bank’s a couple of-12 months label was 6.79 percent, and imperative link you may 6.89 percent of these which have faster collateral. ASB’s one or two-season rates also fell in order to 6.79 per cent.

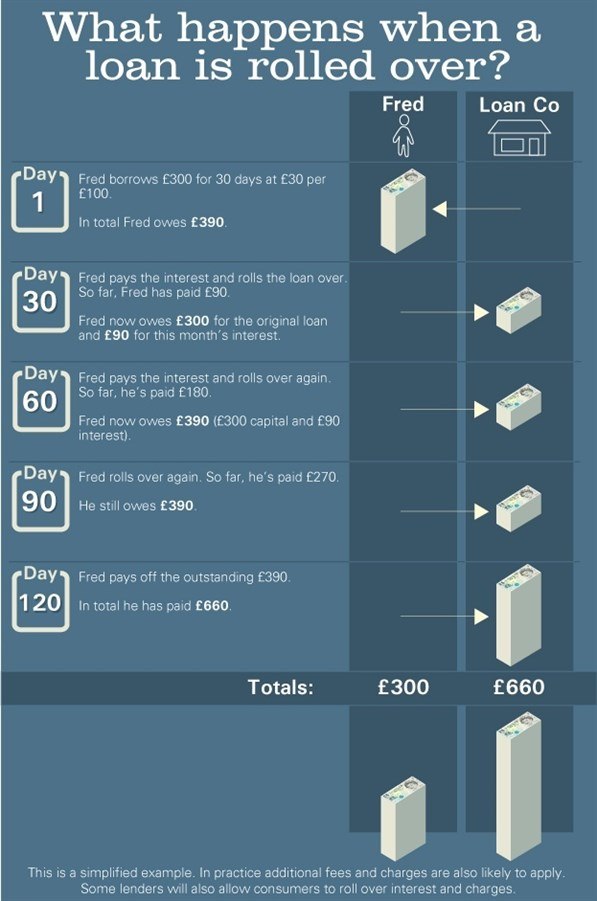

Calculating crack charges

Your price will state you need to pay some slack percentage for individuals who prevent it early, but you will perhaps not know the perfect matter beforehand, Walsh told you.

While break charges can seem to be unjust, there are regulations positioned to ensure banks is actually covering the will cost you rather than taking advantage of all of them.

The financing Agreements and you will Individual Funds Operate claims prepayment costs try unreasonable only when it exceed «a fair estimate of your own creditor’s losses as a result of the fresh part or full prepayment». An elective algorithm is offered because of the Credit Contracts and you can Consumer Loans Regulations.

But some banking institutions, such Kiwibank, incorporate their own algorithm in order to determine charges: «I apply our own statistical formula so you can calculate their repaired price split cost, hence we believe best reflects a reasonable estimate in our loss during these things.»

ANZ’s lead out-of residents Emily Mendes Ribeiro told you customers can increase normal costs with the their property financing of the as much as $250 weekly. In addition to, each year they could make an extra lump sum payment repayment up so you’re able to 5 % of its current amount borrowed.

Estimates depend on the speed words, what lengths compliment of someone was, and you can — generally — the brand new wholesale fixed pricing matter, she told you.

Fixed home loans tend to have all the way down rates of interest than floating or versatile ones, but some borrowers provides a torn financial — a variety of both rates of interest. Zero crack costs affect floating mortgage brokers.

Extenuating points

«[The bank] was losing profits most of the time once they waived they. Banks often realize its agreements and you can conditions and terms, therefore I might become very amazed whenever they waived a recuperation out-of loss for anyone.»

Either, banking institutions can give bucks contributions to attract clients, to assist counterbalance very early fees charge. However these numbers has refused over the years.

Issues

«Clients are appear to astonished at how big the latest fees it face while in the lifetime of modifying rates of interest,» deputy financial Ombudsman, Sarah Brooks told you. «That shock prospects these to complain in order to us.»

Shortly after the Set-aside Bank’s lifted the fresh OCR away from 0.25 to 0.5 in the , «i received a small spike from times in the house credit crack will set you back, specifically cash share claw backs», she told you.