Va lenders wanted zero downpayment hence significantly reduces away-of-wallet expenditures https://speedycashloan.net/loans/school-loans-for-bad-credit/. Mesa State accredited Va buyers can purchase a property costing right up so you can $484,350 instead an advance payment. Virtual assistant jumbo money above you to definitely count are available, but wanted a down-payment considering an algorithm. It is best to talk to a lender about this.

Running your home is an essential part out of existence. While the an energetic obligation service representative otherwise experienced, it’s less difficult for your requirements than for the individual, because of one of the most effective masters, the new Virtual assistant home loan has the benefit of:

- No advance payment

- Zero month-to-month financial insurance rates

- 15, 25 otherwise 31 seasons mortgage terms

- Doing cuatro% seller-reduced closing costs allowed

- Significantly more lenient borrowing guidance

- Loans up to $6000 inside the energy-efficient developments

An advance payment is not needed into the Va loans, nevertheless veteran accounts for expenses closing costs. This new seasoned will pay the fresh closing costs aside-of-pocket, otherwise receive provider and/otherwise bank loans to cover them. A quotation about what we offer try 1% -3% of the loan amount with the more substantial domestic price and 3% — 5% of amount borrowed getting a less expensive home.

The vendor is actually permitted to pay all of veteran’s closure will cost you, doing cuatro% of the property rates. Therefore, you can end paying anything to get a house.

Tip: While you are brief to your readily available finance to have closure assist, allow your realtor be aware that you are to order your home which have a good Va mortgage. The agent might be able to inquire whenever owner will pay for some or all of your settlement costs.

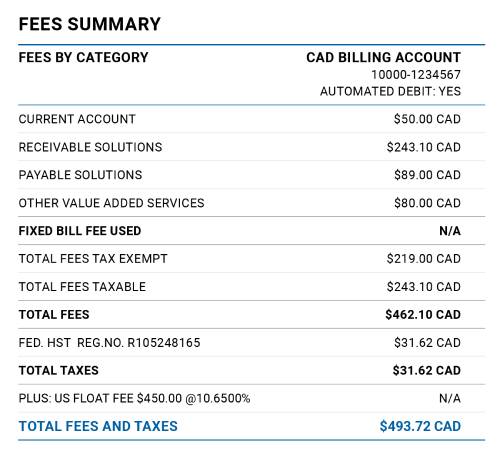

Below are a few meanings and you may rough estimates off closing costs number to own a great Va loan. The kinds of charge and you may numbers are different by the geographic location, their genuine circumstance might look some other. The way to get a better estimate should be to speak to that loan professional regarding your disease. The fresh Va limits the level of costs the lender may charge.

Grand ples:

Virtual assistant Initial Financial support Payment — This fee goes straight to new Veteran’s Government so you can defray brand new costs of your Virtual assistant program. This isn’t a fee which is essentially paid for in the cash from the closing, just like the Virtual assistant homebuyers always choose funds they into their mortgage matter. In this case, it doesn’t increase away-of-pocket costs on seasoned.

1% Origination Commission — The Va caps the fresh lender’s payment on Va funds to at least one% of one’s amount borrowed. That it payment is meant to compensate the financial institution in full. Fees to have affairs such as processing and underwriting may not be recharged when it step one% commission are energized to the seasoned.

Discount Circumstances — Disregard things can be paid down by seasoned, given the cost happens to decreasing the interest rate. Write off situations is actually independent about origination fee, because cash is regularly pick a lower life expectancy rate of interest in the place of to compensate the lender.

3rd party Charge — Enterprises (besides the lending company) which can be mixed up in transaction have been called third parties, such as term enterprises, credit agencies, and appraisers. Listed here are common charges and projected wide variety.

Assessment $five-hundred — The financial institution have a tendency to order an appraisal straight from this new Virtual assistant website. Virtual assistant will discover a medication Virtual assistant appraiser. The Virtual assistant appraiser should determine the worth of the house because well as verify it meets minimum assets criteria.

Tite Declaration/Term Insurance policy $400-$2000 — Which fee differs because it is according to research by the get price of your house, the loan matter, and geographical location. You’ll find fundamentally several version of identity charge: 1) new lender’s title plan handles the lending company, and you can 2) the latest customer’s rules hence handles the long run owner. Generally when you look at the Mesa County owner will pay the particular owner coverage and you can the customer covers the financial institution coverage.

Recording Payment $20-$100 — It fee is determined because of the condition otherwise legislation where the home is discovered. «Recording»ensures that the newest profit gets personal number so the state knows that is in control to expend fees for the domestic, and therefore banking institutions possess money on your house, an such like.

Credit report Commission $thirty five — This can be a fee that is energized by a credit rating agencies. The financial institution have to eliminate a credit history to decide your own earlier credit score. New declaration always suggests three credit ratings about biggest credit bureaus, Experian, Equifax, and Transunion while the center rating is employed to have certification intentions.

Flooding Qualification $20 — The lending company commonly eliminate a ton certification, or «flood cert», to the assets to determine be it in a flooding region. Extremely attributes are not in a flood zone, however if yours was, attempt to buy flood insurance policies (or terminate the new deal to acquire the property).

Questionnaire Fee / ILC Commission $eight hundred — A friends commonly survey the house to determine in which the physical boundaries take the home and you may note barrier contours, sheds, aside houses etc.

Prepaid service Factors — Prepaid products are people who the customer pays in advance. Lenders wanted insurance policies and you will taxes is paid back on closing. Unpaid fees and insurance policies can cause the house are grabbed by the regulators or lost because of the flame instead settlement, both of which are exposure toward financing bank and you.

Flood Insurance coverage — This might be an ongoing insurance plan, repaid each year that you live-in a home which is for the a flood region. The lending company requires the home to become covered facing flooding, which is not covered by the quality homeowner’s insurance policy. You’ll pay the first 12 months premium at closure.

Homeowner’s Insurance coverage — This is the simple insurance plan you to definitely handles against cinch and you can violent storm damage, fell trees, or any other says and you can harm to house except ton and you will quake.

Escrow Put/Tax and you will Insurance Supplies $300-$2000 — That it fee differs since it is influenced by step 1) brand new fees and you will insurance rates towards the family; 2) committed of year the property shuts, and you can step 3) when taxes are collected on the property’s jurisdiction. Such fund must shell out these types of money prior to its due date and be in the new lender’s escrow membership.

Charge Banned becoming Charged toward Seasoned

Questioning how to get additional information regarding the Grand Junction Va financing? Excite call me in the (970) 261-1686 and i is also put you touching several Va Recognized Lenders who can present being qualified pointers, fees and most recent interest rates.

Delight be sure to comprehend my personal almost every other summary of tips sign up for a good Va financial and you may what things to get a hold of for the status out-of property to take and pass an effective Va Inspection.