This present year, The GM acquired AmeriCredit Agency, and rebranded it Standard Cars Financial Organization, a part today competing with GMAC/Ally Monetary. GM set in this new reconstructing of its very own credit business whenever GM Economic ordered Ally’s in the world vehicles credit operations when you look at the 2013, reportedly doubling how big is GM’s in the-family lender. Based on GM, GM Economic has the benefit of funding for around 80% of GM’s around the world conversion process. 23 Similarly, Chrysler re-based an effective tool that provide floors package resource in order to its traders, as opposed to having fun with Ally Monetary. 24

Friend prior to now had well-known lender plans which have Chrysler and you may GM, but these expired from inside the , respectively. They will continue to service car resource to your a couple Detroit automakers, but versus a private agreement to invest in its particular auto conversion extra software. 25

At the time of , Friend Financial is the latest 19 th -biggest You.S. bank holding company, with approximately $149.dos billion as a whole property. twenty-six With its annual submitting into SEC in early 2014, twenty-seven Friend reported around three big outlines off company:

- Broker Monetary Services. These types of services are automotive financing and you can insurance coverage, taking finance, apartments, and you can industrial insurance to help you 16,000 auto people and you may 4 million shopping consumers. These types of surgery had $116.cuatro million out of possessions and you will produced $4.eight mil from overall net money from inside the 2013.

- Mortgage loans. GMAC/Ally Financial typically had high mortgage businesses, however, Ally Financial exited the enormous portions of their residential mortgage operations on the ResCap case of bankruptcy filing and with the divestment out-of most other financial capital activities. The fresh case of bankruptcy courtroom confirmed new bankruptcy proceeding bundle into the . Ally’s mortgage businesses had $8.2 billion from assets towards , and you may generated $76 mil off overall net revenue in 2013.

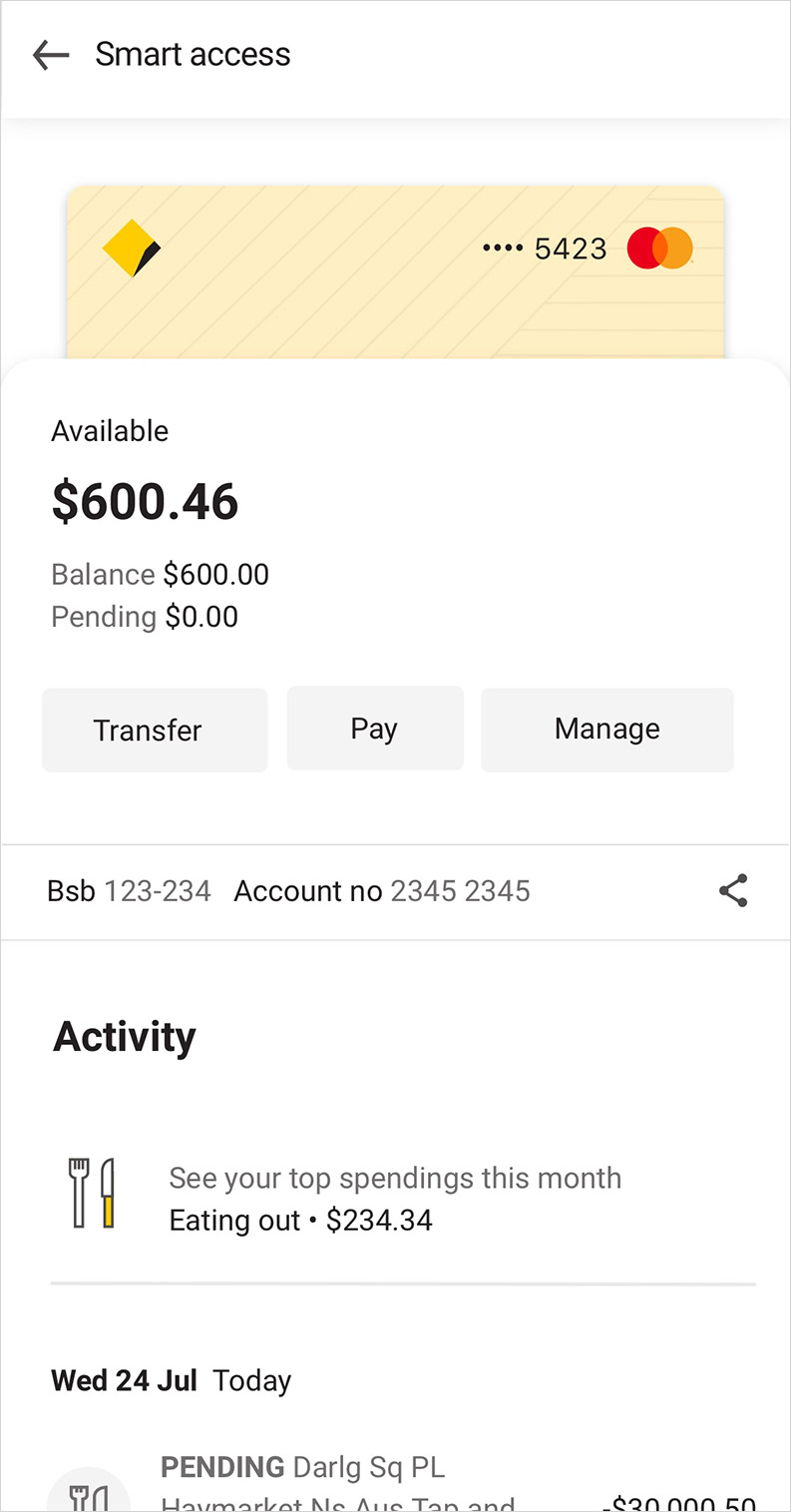

- Depository banking. Ally Financial brings up deposits over the internet, phone, mobile, and post avenues. Their consumer banking products tend to be discounts and money market account, certificates from put, interest-influence examining membership, and you can individual old age levels. After 2013, it got $52.nine mil off dumps, in addition to $43.2 million regarding shopping deposits.

GMAC/Friend Financial’s prior part because the a home loan servicer resulted in then relations which have TARP once the providers took part in the new TARP Family Reasonable Amendment System (HAMP). GMAC/Friend Economic has already established whenever $96 million into the servicer extra repayments to possess participating in HAMP. twenty eight The firm faced ailment to possess papers points with its foreclosure proceedings and you may reported an excellent $230 billion charges for the company’s 2011 money because of property foreclosure-associated complaints. 30

Bodies Advice to have GMAC/Friend Monetary

GMAC/Friend Monetary gained of both general and you will particular authorities recommendations while in the the newest overall economy. Including guidance included (1) Federal Reserve lending place, where a facilities you can expect to borrow funds throughout the Given in exchange for cheap liquids bonds; (2) banks with low interest personal loans in Riverside the latest FDIC’s Short-term Liquidity Be sure System (TLGP), which guarantees debt issued by the banking institutions; and you can (3) the new TARP, and this mainly offered additional financial support to bolster their equilibrium layer.

Government Reserve Advice

Usually, the brand new Given declined to spot private institutions that they borrowed fund. GMAC itself, although not, reported that at the conclusion of 2008, they had $eight.6 billion an excellent throughout the Fed’s Commercial Papers Financing Studio (CPFF). 29 The newest Dodd-Honest Wall surface Highway Reform and you may Individual Protection Act, 31 enacted inside the , expected the brand new Given to detail the crisis lending through the financial crisis; details of eg lending was in fact put out inside late 2010. This launch failed to were borrowing out-of low-emergency business, for instance the disregard screen. Table 2 summarizes what released from the Government Put aside off GMAC/Friend Financial’s borrowing from the bank on the CPFF and Name Public auction Studio (TAF). 32

The Plant and you may Obama Administrations used the Stressed House Save System (TARP) to incorporate guidelines to your U.S. vehicles world, finishing your inability of just one or a few higher You.S. automakers create end up in most layoffs at the same time of currently large unemployment, quick problems and you may downfalls in other parts of the fresh savings, and disrupt most other avenues. The choice to support the vehicle world was not instead controversy, that have questions raised as to what legal reason behind the help and the method in which it had been carried out. The fresh new nearly $80 billion during the TARP recommendations to your vehicle business included approximately $17.2 million having GMAC, hence changed their title in order to Friend Monetary this year.

When Congress failed to admission vehicles industry mortgage statutes, step three brand new George W. Plant Government considered the new Troubled Asset Save System (TARP) to fund guidance for automakers as well as GMAC and you will Chrysler Economic. TARP was actually produced by the Disaster Monetary Stabilizing Act cuatro (EESA) in to target new financial crisis. So it statute particularly registered brand new Assistant of one’s Treasury to buy stressed possessions of «this really is,» the expression and that don’t especially explore production companies or automobile financing enterprises. 5 The authorities inside EESA have been very greater, and you may the Plant and you can Obama Administrations utilized TARP’s Motor vehicle Community Investment Program to provide financial assistance in the course of time totaling over $80 million on several suppliers and two finance companies. Which guidance was not instead conflict, and you will concerns was in fact raised in regards to the judge reason behind the assistance and manner in which it had been accomplished. 6

Record to your GMAC/Ally Economic

Following bodies guidelines and you will reorganizing of your auto globe, GMAC/Friend Economic offered a lot of the ground bundle and you can retail financial support for brand new GM and Brand new Chrysler. The partnership one of the companies, however, has been doing flux.