The new Zealand Acceptance Home loan are a strategy handled of the Casing The latest Zealand to help individuals who’re effective at home loan money however they are struggling to conserve having an effective 20% put.

Anticipate Financial mortgages aren’t subject to the new Set aside Bank’s mortgage so you can worth (LVR) rules because they are underwritten because of the Homes The Zealand.

So what does this new Acceptance Financial include? Qualification requirements:

A pleasant Mortgage means a minimum put of simply ten%. For example, this is often financed of the good KiwiSaver deposit subsidy, discounts detachment, or a gift from a member of family.

You can not use brand new deposit under the Anticipate Home loan. People existing loans which you have might possibly be taken into consideration by bank on the serviceability comparison and you can even when your complement good credit conditions. A mortgage broker would make a point off site right here.

1) Money Limit Limitation: When you are truly the only borrower you must have an entire household money over the past one year of up to $85,000 (before taxation). Whenever you are joining with one or more borrowers so you can buy a home then you can keeps a blended home money as high as $130,000 (just before tax).

2) Anticipate Mortgage brokers is actually simply for properties contained https://www.paydayloanalabama.com/panola in this a certain speed limitation. The absolute most you could potentially borrow relies on the house speed cap into part youre buying from inside the. Into the Auckland, the present day houses cover try $600,000 having existing functions and you will $650,000 for new build services.

4) The individuals cannot individual any assets together with loan can’t be always purchase a good investment otherwise local rental possessions.

5) Brand new consumers should be possibly The brand new Zealand owners or permanent This new Zealand owners (carrying a long-term Citizen Visa).

How come they functions?

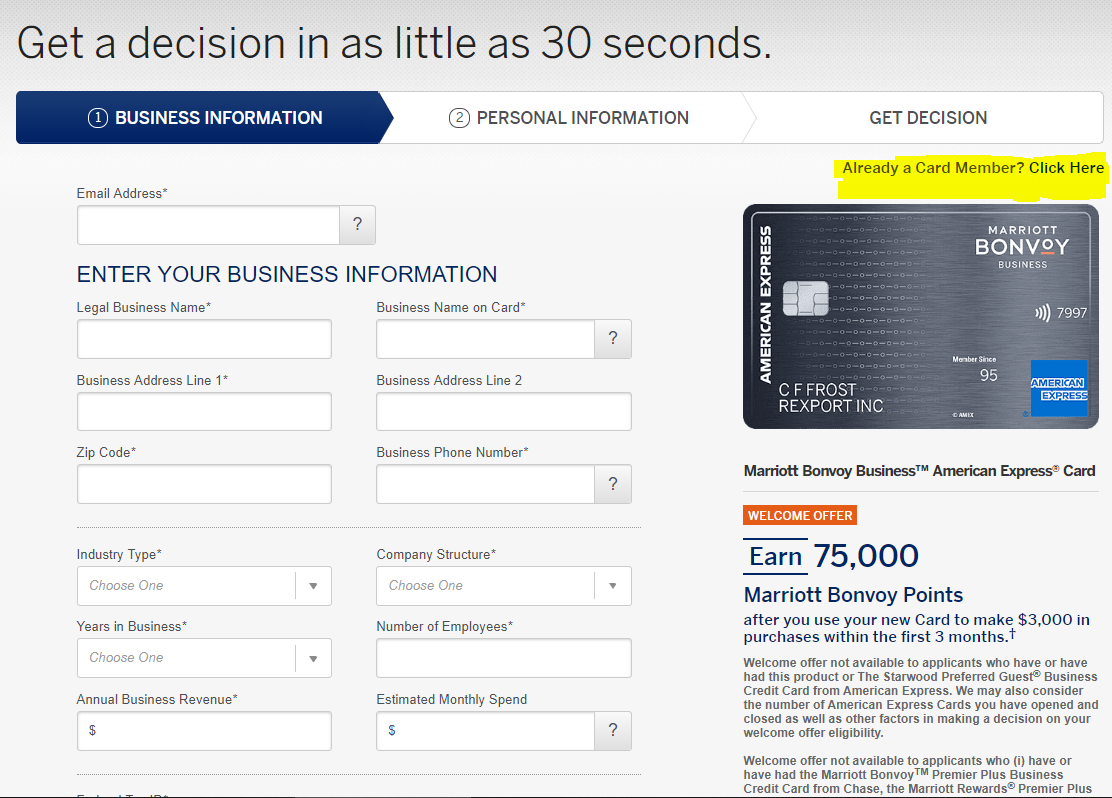

Which constantly happens in several degree. You could make an application for a welcome Mortgage by starting one of the twigs of your participating financial. Find a list of Greet Home loan lenders.

Contained in this basic stage, once you meet with the bank, they would explain to you the scheme along with you and look the monetary history. They might manage a comparable credit line inspections & financial examination while they create for an everyday home loan.

The primary point in that it such as for example is you will require in order to satisfy toward lender’s credit standards, as well as the criteria to the Acceptance Financial system.

For many who qualify, the lender will send the loan app so you can Houses The fresh new Zealand in your stead getting last recognition. At this time, it’s still at discernment off Houses New Zealand since the in order to though you’ll receive the loan.

Normally the house become belonging to a confidence when which have a great Invited Mortgage? Control need to be throughout the borrowers’ labels hence can’t be listed in a confidence.

Imagine if We very own a house overseas otherwise a yacht do i need to still implement? No, this could be recognised since the a great realisable advantage and also you create be required to sell it are believed qualified to receive good Invited Home loan. You will need to get into an equivalent budget just like the a first-date home buyer when it comes to income and you may realisable’ possessions.

Can you imagine We used assets but no further create do i need to nevertheless be qualified? There is certainly nonetheless the possibility of to be an additional possibility domestic owner. Yet not, very lenders would require detail by detail need from what affairs.

Let’s say I would like to build my own personal domestic? Only a few performing loan providers enable it to be consumers to build house with Welcome Financial. This new disadvantage to this is that you will find to pay home financing superior and you can charge. Keep in touch with new acting loan providers about this for more information.