Choose the right Large financial company

A sydney mortgage broker letting you know that you ought to end choosing the incorrect large financial company just what else is completely new? Pay attention to us out whether or not because operates deeper than slandering the fresh other lenders in the Questionnaire. There are many loan providers online, there are a couple of which can do a good job, but from your reckoning he is few in number.

From the Lendstreet, there is heard of an excellent, brand new crappy, plus the unattractive when it comes to mortgage deals one local home loans had been providing due to their customers this present year. Seeking an inexperienced mortgage broker, or perhaps a mortgage broker that will not get best interests at heart is also wind up costing you money and time. Before you could hitch their truck on incorrect pony, ensure that your mortgage broker gets the sense and you can tips to truly get you a knowledgeable price.

Address Their Borrowing Factors

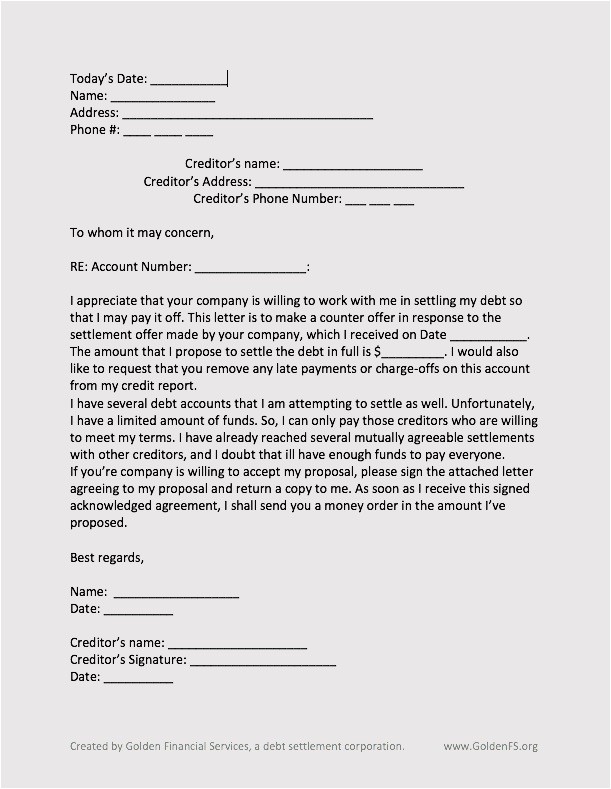

Ahead of selecting an informed mortgage brokers, you will want to address any fundamental borrowing otherwise financial things. When loan providers determine the job, they will certainly to take into consideration their lending background, money, and you will a selection of additional factors. In the event the you’ll find discrepancies otherwise economic problems that are not accounted getting, upcoming lenders might not be happy to accept financing otherwise can offer specific less-than-better loan terminology.

Of the coping with a mortgage broker, you will know where exactly your sit and have the most readily useful opportunity from protecting a beneficial mortgage.

Check around

Regarding locating the best lenders Questionnaire keeps to give, it pays to shop around. Of the comparing rates, costs, as well as other payday loan in Naturita financing keeps, borrowers produces a told credit choice and get this new most suitable mortgage due to their private needs.

There are countless different finance from other lenders. Regarding repaired speed to help you varying alternatives, for every single financial may offer different fine print which is beneficial see what’s available to you.

Require Let

To purchase property is the unmarried premier buy that of us generate inside our lifetime so do not you will need to wade they alone. Educated lenders will save you date, money, and agony. Dealing with a knowledgeable elite means you’ll acquire sense for the other finance and you can possibilities to you and get a sounding-board for everybody of them extremely important inquiries along side means.

When it comes to home financing, one of the most well-known problems that individuals look for try anybody believing that they must sit loyal on their financial. If or not you have been with them since you was basically squirreling away Birthday & Escape money, otherwise you have been together with them for a few ages and you can particularly the way the debit cards looks you need to evaluate other available choices.

Here are about three good reasons why you ought to look beyond their lender in terms of protecting an educated financial revenue Questionnaire has to offer.

Banking institutions Love New customers

Finance companies like clients. It desire legal clients with glamorous cost and personal offers most of the to the detriment of the current consumers. If you’ve been together with your financial for decades, then there is a high probability which you are able to miss out on the new exact same exciting advertisements and you may alluring also offers. Which have Lendstreet, we will comparison shop and you can evaluate the best pricing out-of more 60 loan providers. Carry on, experience the adventure to be single assist all of our lenders contend for your needs for the best family mortgage also offers for the unique things.

Your Limits Could be Down

If you have been with similar bank for many ages, then your limits are below almost every other lenders. Each bank keeps their own unique lending requirements and you may procedures, so your financing possible can differ significantly. Should your financial features refuted your loan otherwise isn’t really ready to render what you think you will be entitled to, upcoming make an appointment with our very own Questionnaire Mortgage broking cluster.