Purchasing your basic house inside iliar words such as escrow will be challenging. Knowledge escrow and its own will set you back is also clear up the new homebuying process and you can help you make informed financial decisions. Right here, we break down escrow axioms, Maryland-certain statutes, and you will exactly what the new homeowners would like to know.

What is actually Escrow? A simple Review to possess Maryland Homeowners

Escrow is actually a monetary arrangement in the a residential property you to definitely covers both customers and suppliers. An enthusiastic escrow account retains currency otherwise very important data before the sale’s requirements was came across. Essentially, it is a basic space where financing was left secure up until most of the functions possess fulfilled its obligations.

Escrow Has A few Phases:

- Pre-Closing: The brand new escrow account briefly retains the new buyer’s serious money deposit. Which deposit indicators the new buyer’s dedication to purchasing the household.

- Post-Closing: Following business was closed, new escrow membership is utilized to invest constant expenditures such as for example possessions taxation and you can home insurance. This helps your stick to best ones will set you back, preventing people unanticipated monetary burdens.

Maryland’s Unique Escrow Regulations

- Loyal Escrow Profile: Condition law makes it necessary that escrow loans feel stored in a devoted membership, independent off their financing. It suppress any punishment and guarantees your finances was leftover secure up until the income is done.

- Clear Disbursement Laws: Money in the escrow can only just feel create immediately after certain criteria, for example all about home inspections otherwise requisite repairs, are came across. In the event your product sales drops as a result of, Maryland rules dictates that currency feel gone back personal loans in California to new rightful group with respect to the deal terms.

- Signed up Escrow Agencies: In Maryland, merely registered advantages is also manage escrow levels, bringing an additional level from coverage and you can compliance for your deal.

Simply how much to put Out for Escrow inside Maryland

Escrow will set you back are different depending on possessions speed, county income tax prices, and you will insurance fees. When cost management for your home, keep in mind that such costs are independent from the downpayment and you will closure charge.

- Escrow Configurations Costs: Paid back on closing, these types of charge coverage the cost of establishing and you can managing their escrow membership.

- Assets Fees: Maryland assets fees are different by the state but are generally repaid through escrow. This means that a portion of their monthly mortgage repayment was allocated for taxation to avoid you against being forced to pay a great higher lump sum after the season.

- Home insurance: Annual insurance premiums are also reduced through the escrow account, so it’s easy to care for exposure without forgotten a cost.

- Personal Mortgage Insurance rates (PMI): When you find yourself getting down below 20%, their lender will likely need PMI. That it monthly premium helps protect the lending company in the event you standard on your own mortgage that will be utilized in your escrow payments. After you have gathered enough equity of your home (always 20 so you’re able to 22%), you I, cutting your monthly payment.

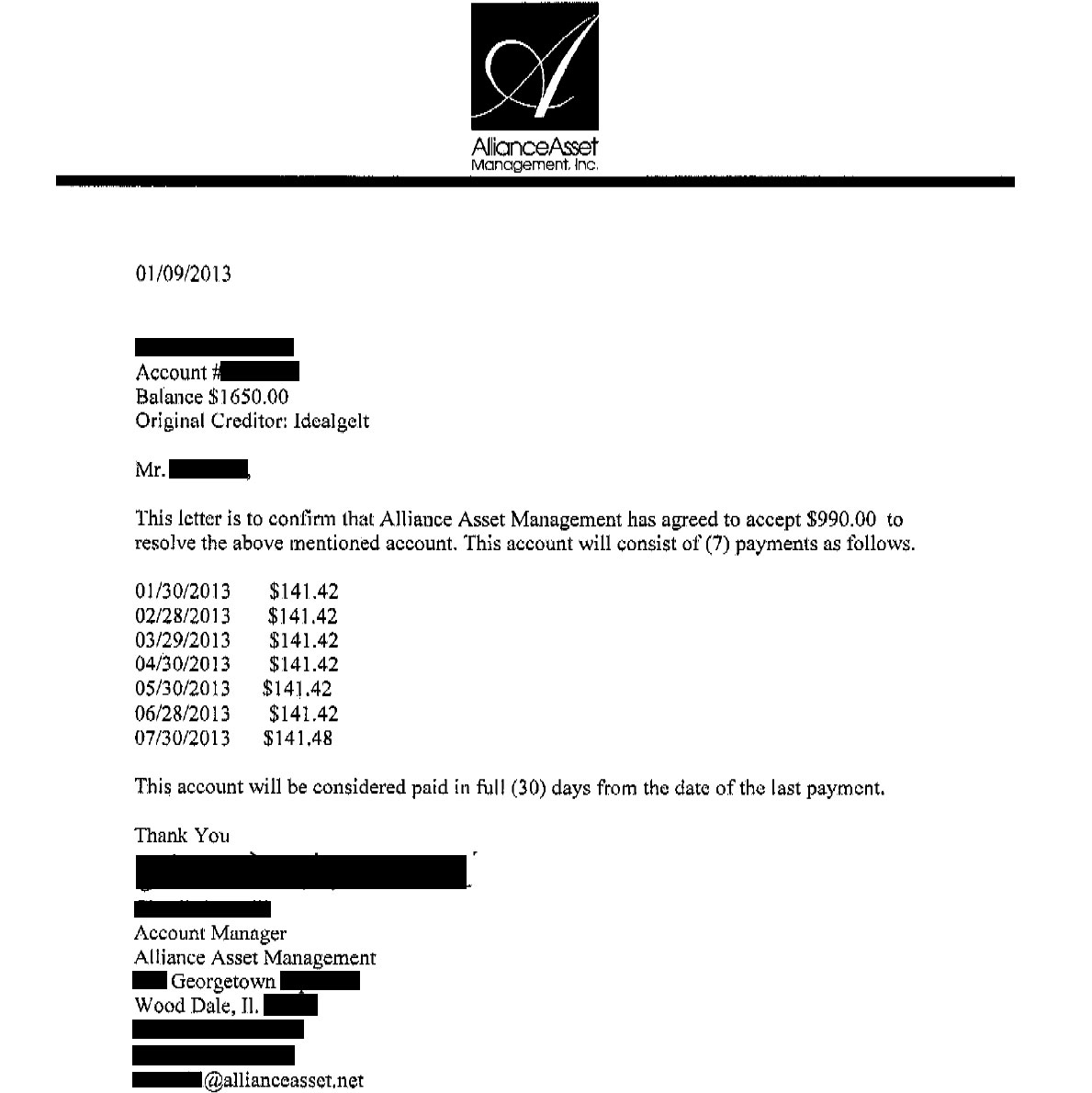

Escrow Costs for a median-Priced Maryland Household

If you find yourself to invest in a property during the Maryland’s average price of $425,000 with a good 10% down-payment ($382,500 loan amount), here is what you may want so you can cover escrow, including PMI.

Keep in mind that the latest PMI rate you will get hinges on points such as your down payment and you can credit history. For this analogy, i put a quotation of 1% of the amount borrowed a year. Their PMI is higher otherwise all the way down depending on your unique situation.

What this implies to you personally:

By the including these costs on your own monthly homeloan payment, you will have one to faster question to consider and can remain focused with your bills.

Why Escrow Levels Work for The Homebuyers

Using an escrow membership also offers several benefits to have first-day homeowners. Of the merging property taxes and you will insurance coverage money with the one in balance monthly amount, you will have a lot fewer expense to track and get away from unforeseen will set you back. It smooth strategy makes it possible to run enjoying your brand new family in the place of worrying over numerous costs.

As to why Favor SECU as your Homebuying Spouse?

Navigating brand new homebuying techniques can be overwhelming, particularly if it’s your first time. This is how SECU comes in. Because good Maryland-dependent borrowing union, SECU features an intense knowledge of local laws and regulations and you will escrow conditions, which makes us a suitable companion to help you as a consequence of each step. We provide:

Exercise

To own Newest Homeowners: Already have a home loan however, not knowing about how your escrow account performs? Discuss SECU’s Escrow Information for beneficial systems and you can information to raised manage your escrow membership.

For brand new Homebuyers: Mention SECU Mortgage brokers to learn how we will help create your ideal out of homeownership an actuality. The audience is right here so you’re able to comprehend the character out of escrow into the your household journey.