Posts

If the a different partnership is not a good withholding international partnership, the new payees cash is the people of your own union, considering the fresh lovers are not on their own flow-due to agencies otherwise foreign intermediaries. However, the brand new payee ‘s the union in itself if the connection try saying treaty pros for the base that it is perhaps not treated because the fiscally clear from the pact legislation and that it suits all of the additional conditions for stating treaty professionals. If a partner try a different circulate-because of organization otherwise a foreign mediator, you pertain the brand new payee determination laws and regulations to that spouse to choose the brand new payees.

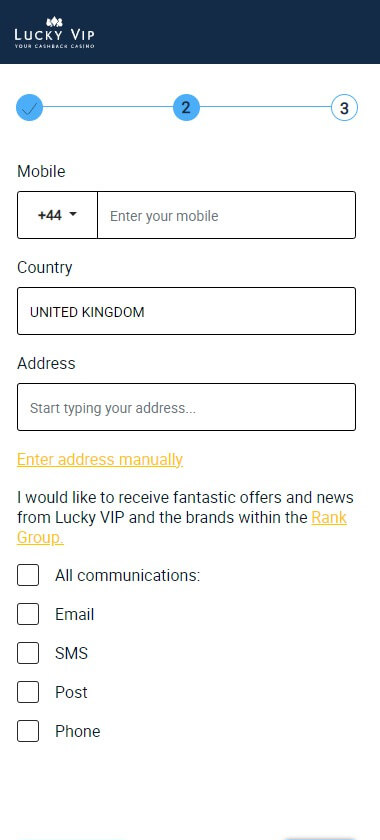

Party casino real money: Professionals from a great 5% Deposit Financial

An entity can get submit an application for QI position during the Internal revenue service.gov/Businesses/Corporations/Qualified-Intermediary-System. Branches away from creditors commonly permitted to operate as the QIs when they found beyond regions that have recognized “know-your-customer” (KYC) laws. The fresh countries with recognized KYC laws is actually indexed from the Irs.gov/Businesses/International-Businesses/List-of-Approved-KYC-Regulations. More often than not, a foreign effortless trust try a different trust that’s needed is so you can distribute every one of its income a year. A foreign grantor faith is a different believe that’s managed since the a great grantor faith below areas 671 as a result of 679. Quite often, a good TIN should be provided by a You.S. nonexempt receiver (an excellent U.S. person susceptible to Mode 1099 revealing) to the Mode W-9.

(Deposit) Legislation, 2000

In such cases, seeking to information of home financing Agent is going to be priceless, even as we have inside-depth expertise in the various lenders’ choices and will help you secure the extremely favorable terminology based on your Party casino real money position and coming requirements. While the First Mortgage scheme demands the absolute minimum 5% deposit, boosting your deposit number could easily discover more favorable lending terms and you can expand your possessions possibilities. An excellent. The brand new property owner ought to provide authored paperwork to your why region or all the away from a safety put will be withheld. The fresh landlord and ought to provide an authored feeling of your own put write-offs. A. Landlords is always to lay funds obtained since the a safety deposit to your an desire results take into account the newest entirety of the book. In the event the a resident resides in the structure for around a good complete seasons, you to citizen can be permitted found their put back and also the desire it generated.

An excellent withholding broker that is a collaboration (whether U.S. or foreign) is also guilty of withholding for the its money effortlessly regarding a U.S. exchange or business that’s allocable to help you foreign couples. When it comes to a publicly exchanged relationship, but not, sometimes the relationship otherwise a good nominee can be accountable for so it withholding, since the placed on distributions by the union (PTP distributions). Really resident security deposits take place within the non-desire affect account inside a florida financial organization.

Money paid back so you can overseas income tax-excused groups are susceptible to revealing for the Function 1042-S. If your organization is a partner in the a collaboration carrying-on a swap or business in the usa, the newest ECI allocable to your company is at the mercy of withholding under area 1446. Lower than unique steps offered in the WT arrangement, a great WT get pertain shared account treatment so you can a collaboration or trust that is a direct recipient otherwise holder of your own WT. These types of legislation merely apply at a partnership otherwise trust that suits next criteria.

In general, you ought to keep back taxation below part step 3 on the percentage away from royalties away from offer in america. However, certain kinds of royalties are provided significantly lower rates or exemptions lower than specific tax treaties. Appropriately, these different kinds of royalties are addressed as the independent classes to have withholding intentions. To own section cuatro aim, royalties is actually nonfinancial payments and they are hence omitted since the withholdable payments.

- People paid back to arrange tax returns for other people need a good comprehensive understanding of tax issues.

- These kinds is given a new money password amount since the some tax treaties excused an instructor from income tax for a small matter out of decades.

- It does already been as the invited reports so you can anyone who has become held right back out of getting to – or rising – the house or property ladder due to it wear’t features a big adequate put.

- (iii) The brand new studio must provide a specified team individual that is approved because of the resident otherwise loved ones classification and also the studio and you can whom is responsible for bringing guidance and you can answering composed requests one to originate from meetings.

- (7) The brand new citizen have a directly to has family member(s) or any other citizen affiliate(s) satisfy regarding the studio to the family members or citizen associate(s) from other citizens in the facility.

You’re in a position make use of the Document Publish Equipment to respond digitally in order to qualified Irs observes and you may emails by properly uploading expected files on the internet because of Irs.gov. Go to Irs.gov/Forms to gain access to, down load, otherwise print all the forms, instructions, and you will courses you need. Mode 9000, Option News Taste, otherwise Form 9000(SP) enables you to decide to found certain types of composed interaction from the following forms. To your Internal revenue service.gov, you can purchase right up-to-date information about current occurrences and you may changes in income tax law.. A great “nonparticipating FFI” are a keen FFI aside from a playing FFI, a good deemed-agreeable FFI, or an excused helpful proprietor.

The connection or nominee need to keep back income tax to your any real withdrawals of money or property so you can overseas couples. The degree of the fresh shipping comes with the amount of one taxation lower than part 1446(a) necessary to be withheld. In the example of a partnership one to gets a collaboration shipment away from another partnership (a tiered union), the new shipment comes with the newest tax withheld of one shipment. Around three versions are expected to have reporting and paying more than taxation withheld for the ECTI allocable in order to overseas people.

- Latest two-sided deals ranging from Ukraine as well as the You highlight the brand new geopolitical importance of these resources.

- But not, see Withholding to the Specific Money, after, as well as the guidelines to your form of variations.

- Despite white of Florida laws, of many possessions managers see these types of usually high deposits strengthening in the bank account and are desirous of staying the eye for their company.

- Earnings effectively regarding the newest run away from a swap or team in the us isn’t a good withholdable percentage below chapter 4 which means isn’t at the mercy of withholding to have part 4 objectives.

Employment by which the newest pay is not felt earnings (to possess finished taxation withholding) boasts, but is not limited to help you, next items. Superintendents, executives, or any other supervisory personnel are group. Quite often, a police of a corporation try an employee, but a movie director pretending within skill isn’t. A police officer that would perhaps not do one characteristics, otherwise only small features, and you can neither get nor is permitted get any spend try maybe not felt an employee. Gives made available to college students, students, or scientists that want the new performance of individual functions because the a expected condition to own disbursing the newest offer do not be considered as the grant otherwise fellowship offers.

Form 8966

The fresh WT need assume first sections step three and 4 withholding obligations to possess numbers that are distributed to, or as part of the distributive share away from, one direct recipient otherwise manager and may suppose number 1 chapters step three and you can 4 withholding obligations for sure of their indirect beneficiaries otherwise people. A WT should provide you with a type W-8IMY you to certifies that WT is acting because capacity and will be offering any other suggestions and you can qualifications required by the form. A good WP will get look for a refund of taxation withheld below chapters step three and 4 on the part of their lovers if the WP hasn’t given a form 1042-S to your people one gotten the newest payment that has been topic to overwithholding. The brand new couples, therefore, are not necessary to file claims to have refund to the Irs to locate refunds, but alternatively could possibly get receive him or her regarding the WP. An excellent WP will get obtain a reimbursement out of taxation withheld lower than chapter 4 to your extent enabled beneath the WP arrangement. If an enthusiastic NQI uses the opposite techniques, it must offer withholding price pond suggestions, as opposed to individual allotment advice, through to the percentage of a good reportable matter.

PNC overseas exchange fees: Over publication

Deposits tend to be licenses of put, open membership date places, Eurodollar licenses out of deposit, or any other deposit plans. To have financial obligation granted just after March 18, 2012, collection attention does not include attention paid back for the debt that’s not within the joined mode, except for desire paid back to your international-focused joined personal debt awarded just before January step one, 2016, while the revealed within the Foreign-targeted registered financial obligation, afterwards. A replacement focus percentage made to the new transferor away from a safety inside a bonds lending exchange otherwise a sale-repurchase deal try managed exactly like the interest to the transmitted defense. Different types of income is at the mercy of some other withholding standards. The brand new expectation legislation, on the absence of documents, on the topic is chatted about on the regulations section shown within the Chart A great. To your reporting standards away from QIs, find Form 1042-S revealing and you will Cumulative refund actions, discussed later on lower than Qualified Intermediary (QI).

If a person functions from the a predetermined point or issues in the the us (including a manufacturing plant, shop, workplace, or appointed urban area or section), the wages to possess functions did as the an employee to have a manager are susceptible to graduated withholding. Earnings paid in order to nonresident alien students, educators, researchers, students, and other nonresident aliens in the “F-step one,” “J-step one,” “M-1,” otherwise “Q” nonimmigrant reputation commonly susceptible to FUTA income tax. Pay for personal services that isn’t subject to withholding is not susceptible to reporting for the Mode 1042-S.

A chapter cuatro withholding speed pond are an installment from a good unmarried form of earnings that is a great withholdable payment that is spent on payees which can be nonparticipating FFIs otherwise recalcitrant account holders (in one single pond). A part 4 withholding price pond does mean a cost out of one form of income that’s used on U.S. payees in the event the QI contains the degree required on the Function W-8IMY for allocating costs to that particular pool and you can a good withholding statement. A good QI cover anything from within its chapter 4 withholding price pools the lead account holders and account holders of another QI or a performing FFI or registered deemed-agreeable FFI. In terms of an installment to a different person whereby zero chapter cuatro withholding is required, a part step three withholding rate pond is a payment of an excellent single type of income which is susceptible to an individual rate away from withholding and that is claimed on the Form 1042-S lower than one part cuatro different password. Money built to U.S. excused recipients can also be found in a chapter step 3 withholding speed pool that withholding cannot use. To possess purposes of section 1446(f), a brokerage may be necessary to keep back during the a 10% rate to your a cost realized in the import from a PTP interest so it consequences to the transferor of one’s desire.

You don’t need to issue a form 1042-S every single receiver found in including pool. You need to have fun with an alternative Mode 1042-S for each kind of money that you paid off for the same person. Repayments built to an excellent QI that will not suppose number one chapters step 3 and you will 4 withholding requirements are treated because the paid back to help you the customers. Yet not, an excellent QI is not required to offer documents it obtains from the international customers otherwise of U.S. excused recipients (You.S. people excused away from Function 1099 reporting). Alternatively, it gives you having a great withholding declaration containing both section 3 otherwise part 4 withholding rates pool advice.