If you are looking to purchase a home, your generally get a loan from a lending company. While you are mortgage loans is the antique treatment for borrow having a house pick, you are able to know of supplier investment. So it private plan anywhere between a buyer and you can a seller varies regarding a traditional home loan in many ways.

What’s vendor funding?

Provider money try a personal deal between buyer and supplier where the dog owner stretches financing with the buyer with no engagement off a lender. In a provider capital plan, this new terms of your house financing was agreed upon yourself ranging from the consumer therefore the seller, exactly who along with will act as the lender. Regarding the lack of a 3rd-cluster financial, new terms of owner funding contract can vary commonly from case to instance.

In theory, seller resource can put on to virtually any home purchase. Used, however, they usually comes up below certain standards. Firstly, the seller generally needs to hold extreme collateral inside your home they are promoting, if not own the house downright. In the event your financial continues to be the fundamental proprietor of the home, it’s impractical owner will acquire approval to have a private deal. Secondly, the consumer can often be (even when not always) somebody who has found it tough to safer a conventional home loan, for some reason.

Merchant capital also can emerge just like the an issue when selling an effective household to members of the family otherwise family members, otherwise when the people already if not see both.

How come vendor funding really works?

Since provider funding is actually an exclusive plan, the vendor and you may customer have to collaborate to reach contract towards the the fresh regards to the loan, regarding the cost to the commission agenda.

Given this liberty, particular supplier capital have a tendency to differ extensively. The simplest preparations are usually all of the-inclusive, and so the provider runs the mortgage towards complete get price, minus one down payment. So it arrangement could very well be closest in order to a normal mortgage, except in such a case the vendor — in lieu of a financial institution — are pretending personally given that financial.

Land contracts is an alternate possible plan. When you look at the a land offer, the customer and you will vendor agree with some kind of joint possession of the house, tend to through to the latest payment is established. Thus far, possession of the house typically transmits outright towards customer. Such as for instance an arrangement can give the buyer an opportunity to build collateral from the assets, broadening the possibility of protecting a conventional home loan towards the bottom of one’s fees label. The consumer can also have to donate to assets servicing and you can solutions during this period.

Lease-options are yet another plan. Within scenario, the customer lifestyle once the an occupant on property. Yet not, instead of old-fashioned tenancy, brand new renter keeps the option to acquire our home after a predetermined timeframe.

Crossbreed plans, in which a lender remains inside it, exists as well. Having a ple, owner lends the main purchase price, with the rest protected by combination of a conventional mortgage and you may the new customer’s downpayment. Assumable mortgages, where the seller’s a fantastic finance toward property move into the fresh new visitors, can certainly be you can in some instances.

The new attractiveness of vendor investment

Into buyer, one of the several upsides away from a provider-financed financial is actually a path in order to resource after they could possibly get or even find it difficult securing a timeless financial.

A separate possible beauty of vendor financing is the relative lack of official oversight. For example, people and you can vendors arrive at individually discuss the information of the cost additionally the measurements of the newest down payment. They may also steer clear of the kinds of settlement costs you to definitely a great traditional financial always means, plus any possible obligation into the customer to acquire private mortgage insurance policies. Also, rather than financial institutions with it, the acquisition in itself can get disperse together less.

Given the potential rates and you can flexibility of one’s plan, vendor financing may also be helpful the owner get more prospective buyers for their possessions. Suppliers may ignore deciding to make the categories of fixes typically informed when preparing a house obtainable.

Seller resource threats and you may downsides

As with any lending contract, seller financial support is sold with threats. As opposed to a conventional mortgage, both consumer and you will vendor are usually subject to a lot fewer legal protections, especially in case off a payment standard otherwise property foreclosure legal proceeding. This relative diminished courtroom defense causes significant stress from inside the case of a conflict within signatories.

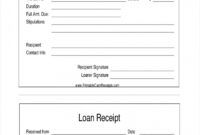

Another type of potential downside ‘s the documents in itself. When you look at the a vendor resource plan, it’s the obligations of your merchant, with the client, to create the new legal agreement. While both parties can get secure the functions out of a bona-fide home attorney to simply help write the fresh conditions, there isn’t any lender inside so you’re able to watch their performance.

At exactly the same time, responsibility to have controlling the import of one’s property’s term and you can purchasing a subject research rests into seller and customer respectively. Meanwhile, the brand new servicing of the home mortgage — promoting bills, gathering costs and you may going after outstanding number — consist straight towards seller’s shoulders.

To the client, you will find prospective subsequent drawbacks. Perhaps one of the primary is that merchant financial support tend to relates to high rates than simply a vintage financial. Those individuals large pricing are typically a function of the other risk the seller are taking on while the lender regarding the relationship. As a result, whether or not a purchaser saves towards the closing costs and you may stops to buy private home loan insurance coverage, they might still come across it shell out a lot more in the long run. In addition to, as the provider investment does not generally want a property assessment, there’s a possibility the visitors may end right up purchasing over market price toward home.

Old-fashioned mortgage versus merchant financing

One to finally significant change ‘s the construction and time of this new loan in itself. Old-fashioned home loans often have repayment symptoms regarding fifteen or 30 many years. With seller-financed mortgages, i thought about this 5 years are a more preferred identity, even when every arrangement differs.

The borrowed funds by itself can certainly be arranged in different ways, having an excellent balloon percentage potentially due towards the conclusion the fresh new label. To meet up brand new terms of any balloon commission, the customer could need to look for money at the time due to a classic lender. Through this section, alterations in brand new client’s borrowing from the bank or even in new appraised worth of the house could help the consumer safe traditional resource.

In summary

Seller funding might provide a path to home ownership for buyers with trouble securing a normal mortgage. not, this type of individual arrangements have threats and you may can cost you of their own. Whenever deciding what’s the proper method for you, its useful to fully envision most of the items and you will seek expert advice.