Building your ideal house would be an extremely fulfilling feel — especially that have a reliable, verbal builder. Yet not, investment a custom made-oriented home constantly isn’t as fulfilling, and regularly gifts its novel challenges. It may be a daunting techniques, particularly if you’re not sure where to start.

For this reason the team in the Norton House are happy to let users navigate the credit techniques, function all of them with a trusting well-known financial. In addition to this rooms, we provide this informative guide so you’re able to understanding how you money brand new home structure in the Minnesota .

Information Custom-built home Funding

A different form of loan is necessary to help you fund a custom create. Since old-fashioned mortgage loans just cover current belongings, building a property in the soil upwards need some thing named an effective structure financing.

Structure loans are supposed to coverage all will set you back of making property, of helping in order to question will cost you to work. New plot of land is normally included in design fund because better, however usually. People desire build on the homes it currently own, although some pay bucks because of their lot and you will money the remainder build will cost you.

Form of Framework Fund within the Minnesota

Bringing financial support to have a housing mortgage when you look at the Minnesota needs a particular number of economic clout. Due to higher concerns, structure loans commonly wanted good 20% down payment or more, and you will a credit score nearing 700 — though conditions are different a bit because of the bank.

You will find multiple form of construction funds readily available, each that have distinct gurus. This is how other build fund work with Minnesota :

One-Time Close Design Mortgage

One-day close construction money inside Minnesota , otherwise known as design-to-long lasting or unmarried-personal construction funds, convert into the a vintage real estate loan following the structure process try complete. These types of loan assurances you will find only one closure process and simply you to set of closure charges. This will save your self each other money and time, but requires an incredibly detail by detail bundle initial.

Once the conditions are locked for the a long time before framework, one-go out intimate design finance offer zero autonomy — though rates lose inside strengthening techniques, or you have in mind modifying your loan terms and conditions.

Two-Go out Intimate Design Loan

Getting greater liberty, you can get a two-day personal build financing , otherwise known as a standalone framework loan. These types of money operate in two independent levels: first, you first rating a loan towards the construction stage, then, as house is founded, your get a vintage mortgage.

Two-time close build funds allow you to look around on the better home loan rates and you will terms and conditions immediately after construction, nonetheless they do encompass several separate closing costs. This is exactly an additional money away from both money and time, it might save a little money in the long run.

Get yourself ready for the credit Process

Understanding the different kinds of structure funds is essential, but thus are learning about the credit procedure alone. This should cover searching for a lender, viewing your finances and requirements, planning for contingencies and you can preparing the required documentation.

Interested in a loan provider

Look for a lender that have expertise in design fund when you look at the Minnesota. Your selection of lender can make an improvement in your resource feel, because it’s their obligation to guide you from the processes — of pre-acceptance into finally mortgage.

Examine new terms out-of several loan providers to find the best match for the project. Although loan providers usually offer comparable conditions, specific range from much more beneficial rates, more costs or any other tall what you should be cautious about.

Learn Your financial budget and requires

As with any huge economic decision, it’s important to learn your financial budget. This includes deciding what you can it’s afford, considering the current and you will estimated coming expenditures for your requirements as well as your household members. Thought this is specially crucial, especially while the design loans want higher off money and interest rates than just antique mortgage loans.

Planning Contingencies

In the event coping with the essential legitimate designers, unanticipated will set you back takes place. This will make it necessary to reserved a spending plan to possess contingencies. When the what you happens according to plan, you are able to repurpose this currency afterwards — maybe even to possess anything pleasing. If the there are some hiccups, yet not, you can easily navigate as a consequence of them without having to rethink your financial allowance.

Required Records

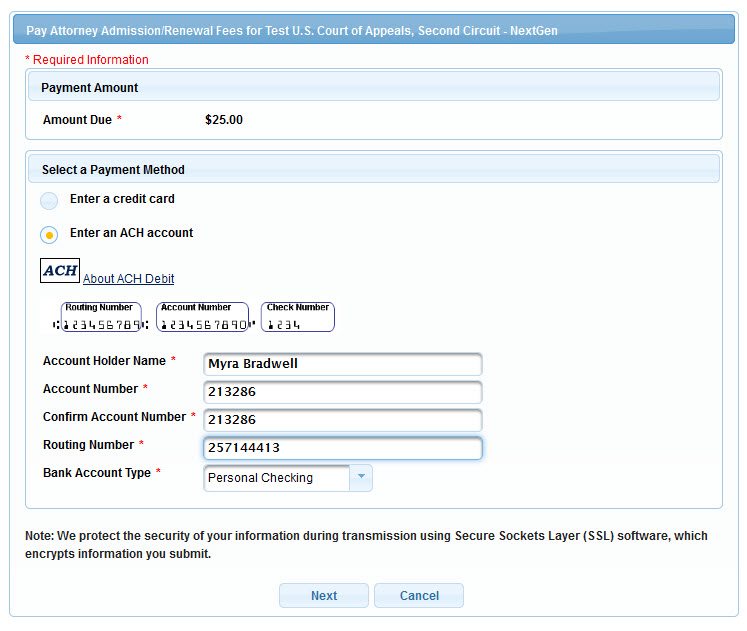

To really get your build mortgage approved, you will need to render certain kinds of documentation. These are generally, however, commonly fundamentally limited to:

- Final build preparations and you will criteria

- Sworn build declaration

- Extent online personal loans Illinois out-of performs

- Buy agreement for the lot (in the event that to get residential property)

- Credentials from your own creator (along with builder’s permit and you may proof of Signed up Standard Builder)

Exactly how Norton Homes Encourages the financing Processes

And make custom home financing an easy and pain-free techniques having their people, Norton Property can help arrange investment. With over 20 years of expertise building custom belongings, Norton has designed a fantastic circle from financing officers that well-knowledgeable regarding framework lending providers. The group tend to set you up which have among the preferred lenders, ensuring that the credit process goes as the effortlessly as possible.

Funding Your dream Bespoke home from inside the Minnesota with Norton Homes

Planning funding is only one small part of the property strengthening techniques from the Norton Residential property. About initially appointment owing to starting blueprints, completing the building stage and you can getting your complete home, the fresh Norton class are always deliver the help and you will interaction your you prefer.

Whether or not you choose Norton Home since your top builder, feel completely more comfortable with both your own builder and your bank. This means understanding the differences when considering you to-some time and several-time construction money, the sort of records you’ll need to get ready, therefore the economic and you will borrowing requirements to take out a property financing — which are more than that of traditional mortgages.

When you are preparing to create your fantasy home, here are some Norton Homes’ portfolio off marketed homes having a tiny motivation otherwise agenda a consultation more resources for this new customized home building and financing procedure.