Introducing Midland Credit Commitment!

Whether or not you voted in favor of new merger or facing it, you age attitude. Merger function transform, and is also human instinct discover anxious regarding changes. You will be asking yourself questions including: I like my most recent credit union, exactly why do we have to switch it? The employees at the Joined all know me and you will my children, I don’t know someone during the Midland, just how am i going to end up being treated? As to the reasons failed to new Panel and you can group on Joined query me to have my personal opinion ahead of it made a decision in order to blend?

This type of questions are common as well as the proper way for me in order to address all of them should be to contrast which along with you purchasing another type of pair of shoes. You go to the latest footwear store along with your partner otherwise good friend. You put on individuals shoes, choosing the right of these. They did its research and searched almost every other borrowing unions, investing pointers, inquiring concerns, and you may interviewing its leaders. They then lead one which just the financing commitment they noticed are ideal fit for the latest Joined membership.

Why don’t we come back to the new shoe research getting one minute. You happen to be during the shop, discover a pair of footwear, walking for the reflect, looking at either side, and you will walking up and down the brand new aisle. The shopping companion claims, The individuals look great for you! You think to help you on your own, I do believe thus too. Nevertheless forget, because footwear getting diverse from your current shoes; do you consider you are going to particularly them nevertheless aren’t sure, they just are not the same. You may well ask find out this here oneself why must I purchase these footwear? They appear sweet, while listen to anybody else are happy with these shoes. Brand new shoe brand has been around providers extended, so they must generate good quality boot. However, you ask on your own, why in the morning We nevertheless seeking to pick it up?

United Borrowing from the bank Connection

Never to oversimplify it, however, wanting the newest boots feels like the new merger before you can. Midland Borrowing from the bank Union has been around the credit partnership company, providing their players to possess 91 years, plus they always grow inside membership. Which means you think to yourself, Midland should be doing things correct. Over the last 5 years, Midland has expanded their subscription from the 17%, and far of these gains has come from recommended tips of present people, like their shopping mate who is indicating you order you to brand new pair of shoes. The brand new Board and government at the United confronted quite the opposite at their borrowing relationship, registration had shrank by -16% more than one exact same five year several months.

Very back once again to the shoes. You opt to purchase them or take all of them domestic. Initially, the shoes do not feel as comfortable, and also you concern your self again. They’re not your dated footwear, but simply such as for example when your dated shoes have been the new, they grabbed a while to break them for the as well as your feet to fully adjust to the size, complement, and you can comfort those people footwear produced you. An identical is valid that have a good merger; the idea of getting the account count change or the borrowing from the bank connection circumstances alter is actually discomforting however, throughout the years you understand is actually it anywhere near this much away from a big difference.

Over the next few days, you are aware you love a number of the have that old footwear didn’t have. You love the added arc help, the fresh new stable heel, and how tiny he is, impression more confident you chosen the proper boots. This really is exactly like just what all of our several credit unions developed by merging: more substantial feet out of property instead of a replication from obligations you to definitely contributes to a great light, inexpensive credit relationship, and deeper amount of Financing Supplies to simply help climate downturns inside the fresh benefit.

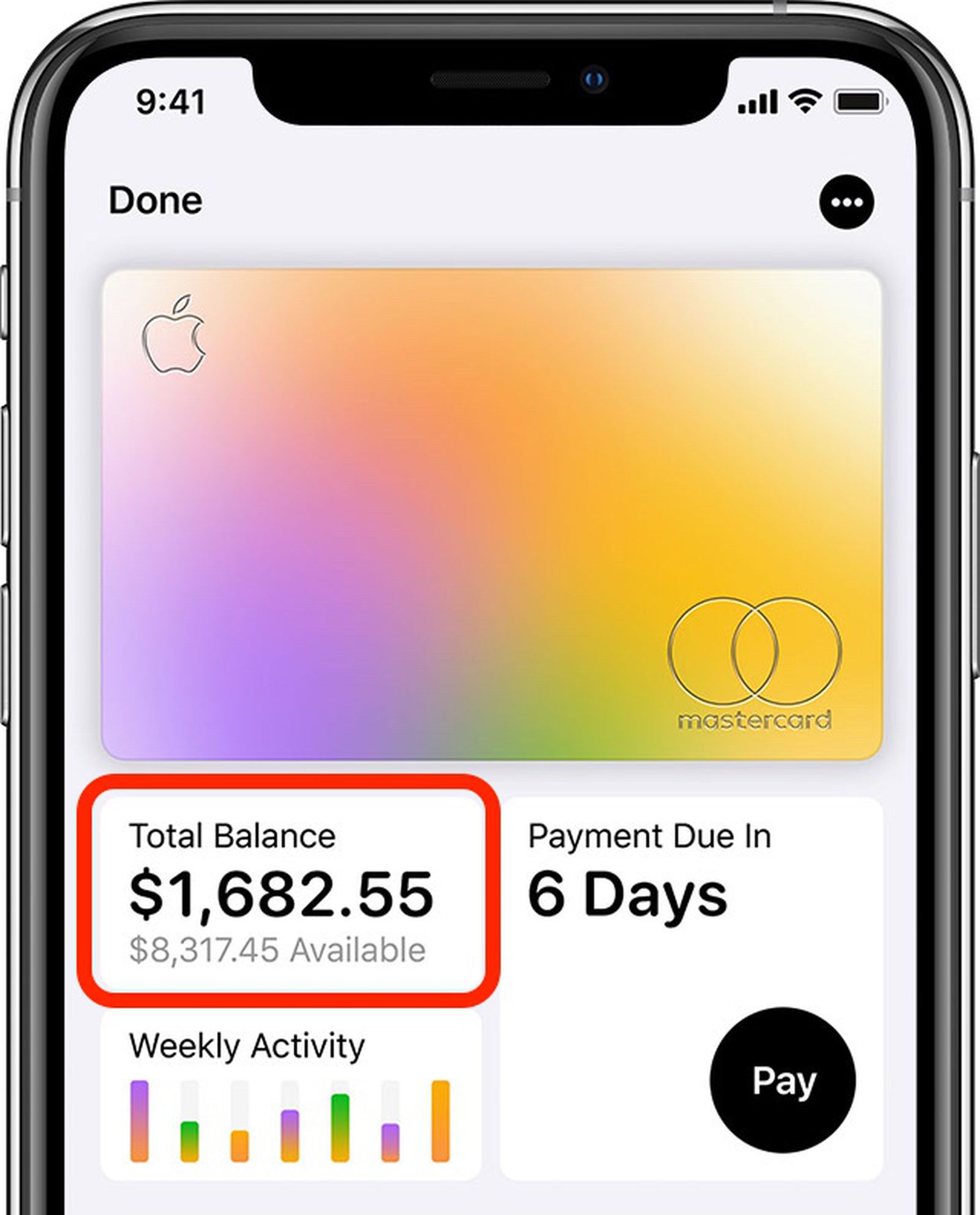

You can enjoy the fact you now have the option of to purchase a separate house by using benefit of Midland Borrowing Union’s First mortgage possibilities available for you or even the capability of property Equity Line of credit you could accessibility funds when you need them. You can also gain benefit from the defense that accompanies our Cellular Handbag, taking a secure treatment for store your own commission information on your portable. Digital or Mobile purses offer a supplementary coating from coverage as debit cards analysis or borrowing from the bank relationship account information are never disclosed when making a transaction. Since it is contactless, you don’t need in order to physically fool around with or hold your debit card.

Rest assured that the new United and you may Midland Board and group simply take providing their players positively and can take most of the scale you are able to in order to restriction one serious pain you can even end up being. Transform occurs in every organization. New Midland team would-be indeed there to answer your questions, assist with establishing your web Financial and Cellular Banking, works behind the scenes to ensure automatic money and you will deposits manage effortlessly, and most importantly, make one feel yourself and at serenity along with your borrowing from the bank partnership.

As with the fresh footwear, i ask that give Midland Borrowing Union a spin and you will discover for yourself the latest Midland Change!