While the retired people go into another type of stage within their lifetime, dealing with economic requires and you can information gets vital. The growth out of after existence credit over the past very long time provides assisted of several retired people use to the old-age, overcoming early in the day age restrictions from antique mortgages. In this article, we’re going to talk about these mortgages in more detail.

What exactly is later on lifetime lending?

After lifestyle lending makes reference to a variety of lending products and you may selection customized into requires men and women inside their retirement many years. These things recognise one to retired people provides line of financial requires, including complementing senior years money, funding healthcare expenditures, and work out renovations, or increasing the well being.

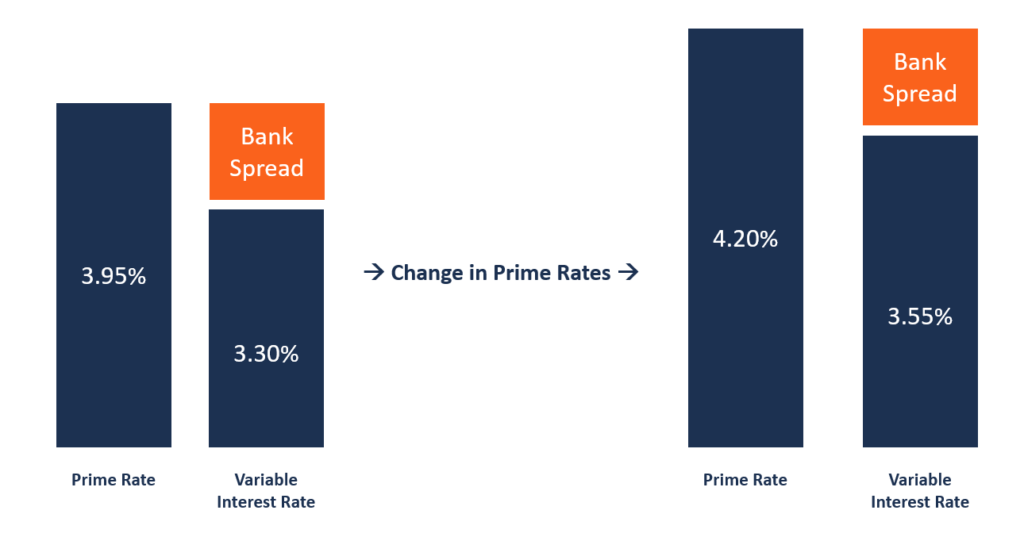

Old age mortgage loans are typically set-up because the life mortgages, and thus they’ll continue through to the last person keeps died or gone for the permanent proper care. The mortgage are safeguarded up against your property, and you also ordinarily have the option of a capital and you will focus set up, particularly a simple installment home loan, otherwise an attraction-just put up.

Preciselywhat are Advancing years Interest-Just Mortgage loans?

Senior years Notice-Simply mortgages, known as RIO mortgage loans, was a mortgage equipment built to offer elderly residents, generally speaking the individuals old 55 or higher, with the ability to obtain on senior years. Your debt will then be paid back if home is offered, always following the history surviving citizen passes away or https://availableloan.net/personal-loans-ga/ movements with the a lot of time-label proper care. For this reason Advancing years Appeal-Merely mortgage loans don’t have an-end time, rather than a fundamental mortgage.

As you are just paying down the attention, additionally end up being protecting the newest guarantee in your home. Following property is sold and loans are repaid, people remaining collateral is deserted since the genetics on the friends. Should you want to pay off a few of the loans before this section, you could potentially favor a great deal that allows overpayments.

Who qualifies getting Later years Interest-Merely mortgage loans?

Old-age Appeal-Only mortgage loans are going to be an important monetary services having retired people, yet not folks could possibly get be eligible for all of them. Part of the limit ‘s the decades that individuals must be to be considered. Usually, Old age Desire-Only mortgage loans are capable of old consumers old 55 or higher who are already in later years or addressing retirement. If you are more youthful than just that it, an alternative choice to imagine is actually an elementary desire-just financial.

An alternative element to look at is the affordability examination presented of the lenders. Might evaluate an effective borrower’s capability to make notice costs and you will, at some point, pay off your debt if financial label concludes. During their examination, loan providers commonly normally think some issues, as well as your earnings, retirement, investments, and overall economic balances. Simply because they would like to make sure to have the method for security the eye costs and therefore your money is enough to handle the latest eventual installment of financing.

The worth of your home also plays a part in eligibility. Lenders possess minimum value of criteria, such as the percentage of possessions you own if you have an excellent financial, in order that the house or property brings sufficient coverage on the financial.

There will also be situations where a separate financial product is much more suitable for you than just a retirement Attention-Just financial. Like, you efficiently spend a made with the undeniable fact that Old-age Attract-Just mortgages don’t have an-end date, which means the eye pricing on these brand of mortgages can feel high. If you can qualify for a simple notice simply home loan, this is certainly a much better selection because the rates are more likely less than into the a beneficial RIO home loan.

The professionals in the Saga Mortgage loans, provided with Tembo, are-versed about restrictions out-of RIO mortgages, and certainly will make it easier to determine if these are the proper financial product for your later years means, and you can which lenders are probably to accept your application. and can assist prospective consumers determine if it meet with the lender’s particular decades criteria. Start today.