As well as interest exposure, households’ strength so you’re able to income surprises was assessed having fun with a chances of default (PD) design. There are a few options for quoting PDs: among them is using historic research regarding real non-payments and you can fitted a logistic regression. The ECB set-up an effective pooled logistic regression design, predicated on mortgage height investigation and many macroeconomic symptoms, so you can guess that-year-to come possibilities of default having mortgages. It model helps you receive away-of-sample PDs below standard and bad situations (Chart step 3, panel b).

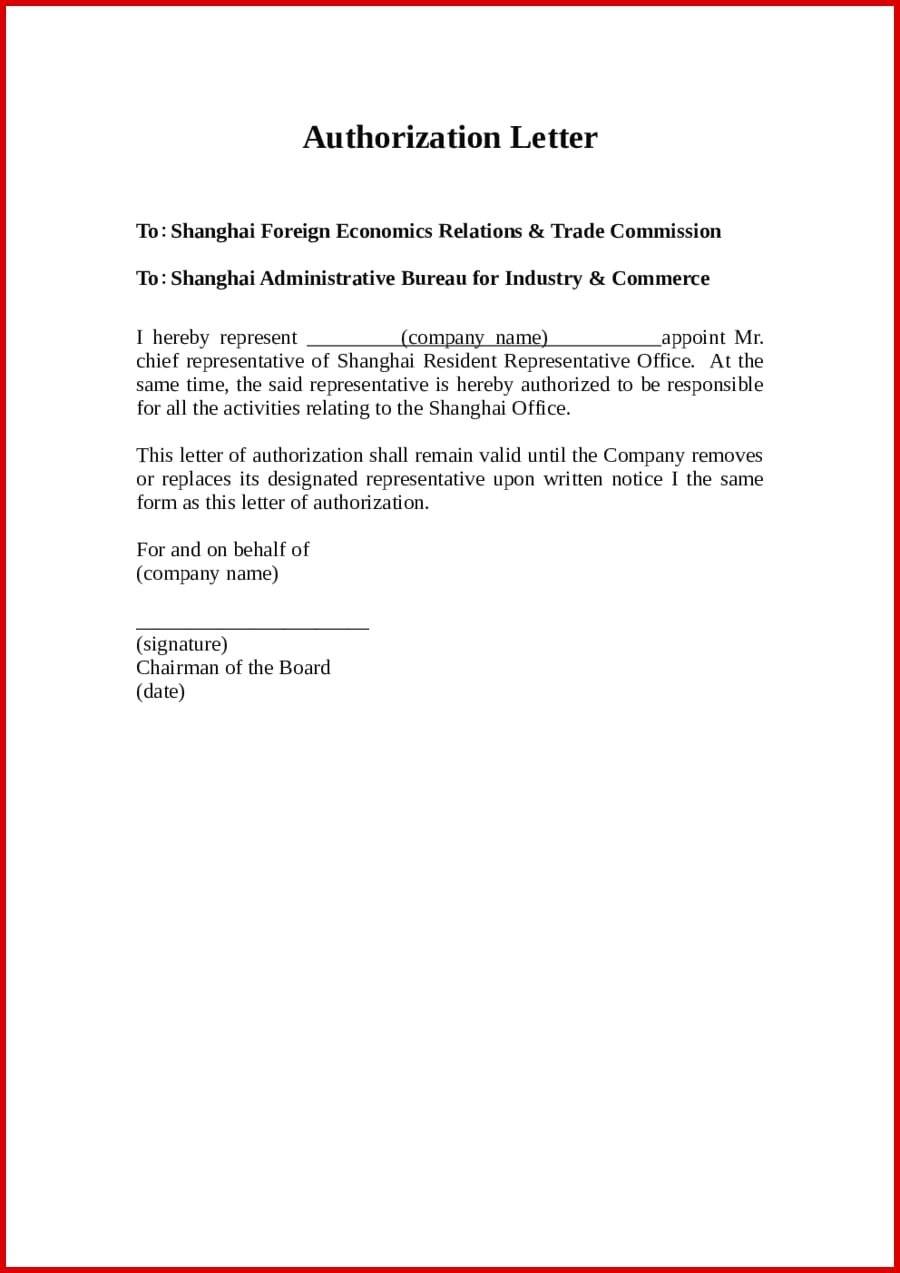

Graph step three

Monitoring financing criteria at the origination provides a measure of bank chance providing, and you may projecting household non-payments assists with examining dangers regarding home industry

Sources: EDW, ECB and ECB computations.Note: Considering studies available for Belgium, Germany, Spain, France, Ireland, Italy, the netherlands, and you can A holiday in greece. This type of charts fool around with details about securitised mortgages alone (possibly ultimately causing solutions bias) and might maybe not ergo feel an exact meditation off federal home loan locations. Committee a: overall weighted by the GDP.

Fundamentally, country-particular organization and you will structural top features of casing places may affect the fresh seriousness of cyclic weaknesses understood. This type of secret provides is RRE markets custom loans Towaoc services (owning a home speed, typical readiness, therefore the restoring regarding housing loans), leasing sector restrictions, fiscal coverage and you may purchase can cost you. It plifying and mitigating impact across the a residential property cycle, plus the impact tend to hinges on connections with other policies (e.grams. economic coverage). People escalation in interest rates would, by way of example, provides an instant and you will big affect loans services burdens for homes inside the countries that have increased proportion out of variable rate mortgages than in men and women in which fixed rate mortgage loans prevail. When you are ascending rates for the places with mostly repaired price mortgage loans will connect with faster your family loans provider load getting established consumers, it can apply at even more bank profits since resource cost you are going to adjust shorter than just mortgage rates. At exactly the same time, supply-front side attributes (the purchase price flexibility of new homes, controls and you may spatial thought) and demand-side items (class and alterations in home formations) are essential RRE locations. Thus, new ECB takes such under consideration inside determining RRE segments, along with the results of this new analytical tools presented more than.

cuatro Conclusion

The fresh new complexity out of RRE locations as well as the several avenues through which unsustainable RRE ents you can expect to threaten monetary balance guarantee the use of a collection out-of devoted designs. Brand new ECB uses several products layer numerous exposure groups to find a standard understanding of the fresh weaknesses stemming regarding RRE places. Model-founded steps fit much easier indicator-established chance tests and sign up for a much deeper monetary investigation. But not, this new the inner workings from RRE locations imply that perhaps the top logical model can only be an excellent simplification of your own truth. The brand new ECB was hence conscious of the brand new caveats and limitations away from this new patterns they uses and you may constantly refines their toolkit so you’re able to echo the new guidelines based on other establishments and you can educational books.

Sources

Deghi, Andrea, Katagiri, Mitsuru, Shahid, Sohaib and you may Valckx, Nico (2020), Predicting Drawback Risks to accommodate Rates and you may Macro-Financial Balance, IMF Performing Paperwork, Global Monetary Financing, Arizona, 17 January.

Dieckelmann, Daniel Hempel, Hannah, Jarmulska, Barbara, Lang, J. H. and you will Rusnak, ), House Prices and you may Ultra-low interest rates: Exploring the Nonlinear Nexus, mimeo.

Drehmann, Mathias, Borio, Claudio, Gambacorta, Leonardo, Jimenez, Gabriel and you will Trucharte, Carlos (2010), Countercyclical financing buffers: examining options, BIS Functioning Records, Zero 317, Financial getting Around the globe Agreements, Basel, twenty-two July.

Jorda, Oscar., Schularick, Moritz and you can Taylor, Alan Meters. (2015), Leveraged bubbles, Record out of Economic Business economics, Vol. 76, Topic — Enhance, December, pp. S1-S20.

Lang, The month of january Hannes., Izzo, Cosimo, Fahr, Stephan and you may Ruzicka, Josef (2019), Planning on the fresh new boobs: another cyclical systemic exposure indication to evaluate the alternative and you can seriousness regarding economic crises, Occasional report series, No 219, ECB, Frankfurt are Head, February.