Renovations can feel overwhelming in the beginning, however the persistence can be beneficial in the future. This is exactly why it is so crucial that you get the best home improvement money.

Also approaching basic items, fixing and you will enhancing your household comes with the possibility of improving its market value if you decide to market it. Enhancing your house brings an approach to target important requires if you’re incorporating coming really worth.

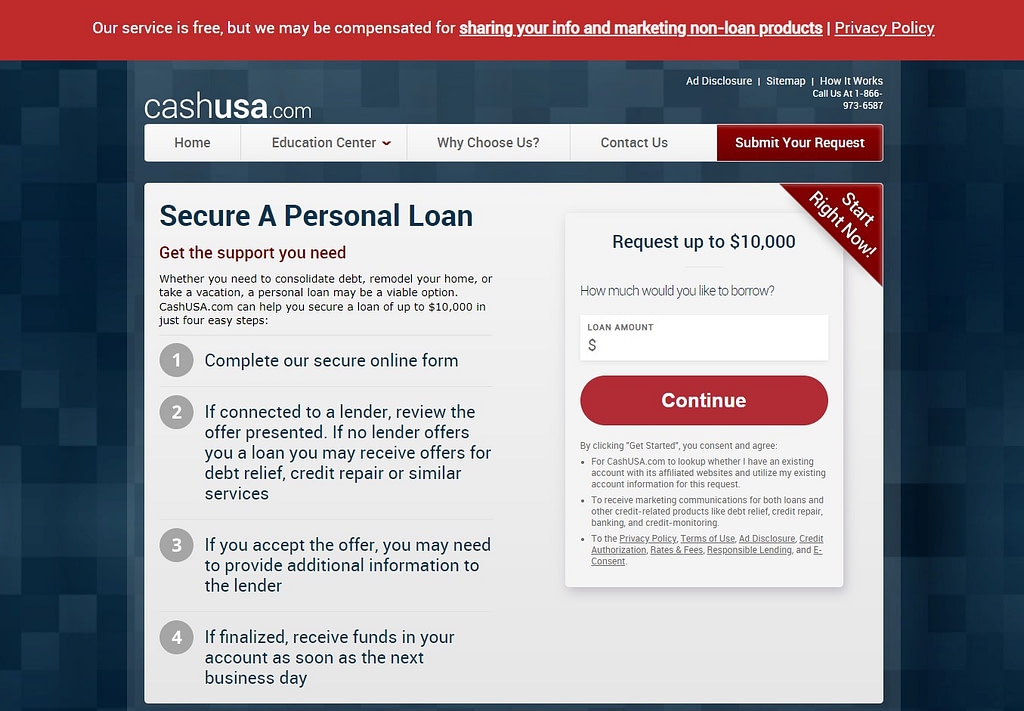

Home improvement financing are going to be unsecured personal loans you to vary within the one another rates and you will words, dependent on points like your credit history. Prior to taking out that loan, research the possibilities and now have several quotes concerning works likely to be done on the household. A very carefully picked home improvement mortgage makes it possible to reach the house of your dreams.

- Most useful Total: SoFi

- Perfect for Advanced Borrowing: LightStream

- Ideal for Reasonable Credit: Update

- Ideal for Less than perfect credit: Upstart

- Good for Versatile Conditions: Marcus

- Best for Big House Fixes: Get a hold of

- Perfect for Contrasting Lenders: LendingClub

- 7 Ideal Unsecured loans for Do-it-yourself

- Home improvement Unsecured loan Requirements and you may Conditions

7 Ideal Signature loans having Do it yourself

Fund to have do-it-yourself create upcoming home improvements and you may repairs a reality. Before taking away a loan, score numerous rates with the cost of your own created do it yourself.

Account fully for injuries and unanticipated events when asking for the total amount borrowed. If you feel the sum of is actually higher, consider wishing and you will saving additional money. However, in the event that specific renovations is actually seriously requisite, think breaking home fixes to your plans classified of the urgency. Consult with an economic adviser and look into the loans open medical loan for ivf to discover what type might be best to you.

Repaired cost regarding seven.99% Annual percentage rate to help you % Annual percentage rate Apr mirror the latest 0.25% autopay write off and you will a good 0.25% lead put discount. SoFi rate range try most recent as of 8/ and generally are susceptible to change without notice. Only a few costs and you can amounts found in every says. Pick Unsecured loan qualification facts. Not absolutely all applicants be eligible for a decreased rate. Lower prices arranged for creditworthy borrowers. Your genuine price will be within the selection of costs detailed more than and will confidence numerous items, as well as evaluation of credit worthiness, income, and other situations. Look for ples and you can conditions. The brand new SoFi 0.25% AutoPay interest cures demands one commit to generate month-to-month principal and you will interest payments from the an automated month-to-month deduction of a good coupons or family savings. The benefit usually discontinue and start to become destroyed to possess episodes where that you don’t shell out of the automatic deduction regarding an economy or bank account.

SoFi started in 2011 and today enjoys over step three billion professionals. The company in the first place focussed on figuratively speaking possesses due to the fact branched out over manage other areas off fund such financial and you may spending.

What makes the newest giving book would be the fact SoFi will bring a particular do-it-yourself mortgage that’s a keen unsecured personal loan. Unsecured loans do not require security and therefore are looked at as less risky for the borrower. Additionally, the mortgage provides the prospect of quick acceptance, that may bring less than a day. You are able to generate fixed payments more than a set title so as that there aren’t any errors otherwise way too many stumbling stops along the way to help you cost.

Top Home improvement Money

SoFi claims there isn’t any minimal credit rating wanted to located a consumer loan but encourages individuals working into the reaching highest credit scores before applying. SoFi explores someone’s creditworthiness to determine whether they is actually a viable candidate to possess a consumer loan.

Overall, SoFi usually requires higher fico scores for personal loans even when an accurate amount to have a house update mortgage is not clearly said.