If you find yourself a keen escrow account will likely be highly of good use, you should be aware of all of the pros and cons before you go send with to acquire a house. The main advantage of an enthusiastic escrow account is that your money might be safe given that a house purchase is actually constant. Let’s say you to a buy agreement is actually set but the review implies that the damage toward home is more substantial than you first thought.

If you don’t have an enthusiastic escrow account and also have as an alternative offered the down-payment to the seller, they may not get back the cash you offered. That have a keen escrow account makes you stop this problem completely. Escrow membership are also advantageous for the citizen plus the financial institution. When you find yourself a citizen, you won’t need to work with using your home taxation and you can insurance premiums in a lump sum payment. For loan providers, escrow profile are advantageous while they make certain you shell out your residence taxes and you can insurance fees on time.

In spite of the benefits that are included with an escrow membership, there are also a few problems that you should be aware from. Once the a homeowner, their mortgage repayments often inevitably end up being large, that will be frustrating while you are seeking put a rigid finances in your monthly expenses. As mentioned prior to now, the fresh income tax repayments you create are merely quotes. In case the guess is simply too lower, thus you wouldn’t are able to afford in your escrow account after the entire year. In cases like this, you would have to compensate the real difference out of your deals.

Regardless of if escrow is amongst the more complicated words possible pay attention to when purchasing a house, the truth is that an enthusiastic escrow account is nothing over a checking account one temporarily keeps fund. Given that you happen to be familiar with what that it name means and just how they affects your position since the a purchaser and you may citizen, you should be self assured for the household-to get process.

An escrow membership are set up by your lender to assemble and you will hold fund to spend specific possessions-associated expenditures. These types of expenditures will tend to be property taxes, homeowners’ insurance, flood insurance policies and personal mortgage insurance policies (PMI). A keen escrow account is a convenient way to provides SouthPoint Domestic Home loan do the brand new commission of the taxation and you may insurance coverage expenses getting you.

How it functions

Their monthly homeloan payment ount becoming paid into the escrow account for fee in your home taxation and you may insurance coverage.

Calculating Escrow Payments

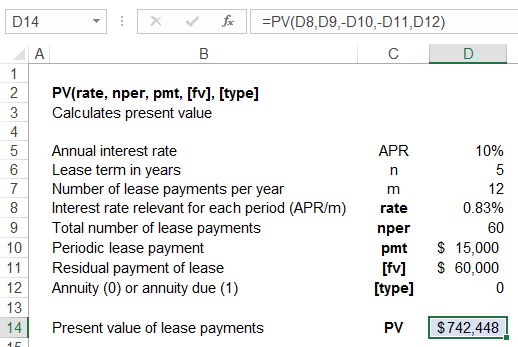

- To prepare your own escrow account, we’re going to split the projected yearly tax and you can insurance coverage bills because of the twelve and are the ensuing amount to the monthly mortgage repayment.

- Each month, we are https://paydayloanalabama.com/meadowbrook/ going to deposit the latest escrow part of your own homeloan payment to the escrow account to pay their insurance premiums and you will taxation when they’re due.

- We also require a 1 month escrow percentage cushion to fund unanticipated will set you back, like income tax or insurance policies grows. This cushion is additionally known as the allowable low balance for the your escrow account.

The amount you have to pay in the escrow account try determined on closure immediately after which reviewed a-year. These repayments increases otherwise drop off as your taxation or insurance premiums change. Since your financial, SouthPoint Home loan doesn’t handle these types of can cost you.

Escrow Data

SouthPoint Real estate loan reviews your own escrow account each year to make yes you will find enough financing to cover individual home loan insurance (PMI),***, homeowner’s insurance coverage** and/otherwise property taxation. Which escrow studies will highlight the level of taxes and you can/otherwise insurance repaid in your stead in earlier times 12 months with the cash out of your escrow account. The brand new escrow data also features whatever you endeavor to expend 2nd season. During the time, there is a surplus otherwise a shortage.