Getting pre-approved for your home loan is a significant first step. Its basically letting you know that you can manage a home. It is a nuclear bomb on your arsenal and you will allows providers and you can agencies be aware that you will be really serious. However, this is simply not the conclusion debt paperwork, and you may does not always mean that you have what you safer. You can still find a good amount of hurdles to conquer. Listed here are 8 what things to bear in mind where period ranging from pre-recognition and signing the last records

Keep Automobile If you don’t Move in

Let me reveal a phrase that you’ll hear A lot throughout this short article. DEBT-TO-Income Proportion. This will be probably one of the most tips to keep from inside the brain for the entire process off obtaining your house. Be sure that you dont add more financial obligation to what your now have, or they trigger warning flags in the procedure. We will focus on your own credit during your software, but we will plus glance at again ahead of i settle, so that little extreme provides occurred. If you buy yet another auto and you can add a good amount of loans for you personally, it can skew your credit and you may push us to need certainly to to switch the borrowed funds. Wait until once you to remain the new dotted range, men.

Never Start You to definitely New Jobs Yet

Something that mortgage businesses instance us like to see are Balance. You want to be aware that youre set in your task and are not attending maneuver around, given that we require one repay your own financial. Certainty in your position is a huge factor in the financial, of course you all of a sudden button work, or begin a different sort of providers, your own financial support items change, and we also need certainly to readjust your application to fit it. This will cause their rates to change just like the trust from inside the your ability to repay the loan may drop-off.

Remain One Regular Paycheck

This is a comparable need. Even if you will make more money straight away, an alternate, heavily-accredited business scares home loan people. Heading from a guaranteed paycheck to a single where you can create significantly more quantity on a monthly basis is a play, and never the one that financial organizations wish to rating sprung into all of them shortly after they’ve already viewed the constant income.

Allow your Currency Settle

Let your currency settle. Banks and you may home loan enterprises do not like to see your money getting around once we agree your to have a home loan. It generally does not inspire believe to see thousands of dollars gone to. The lending company will often make sure finances reserves to ensure you could spend the money for settlement costs associated with the home loan very maintain your currency where its.

Keep Bills Latest

Even if you is disputing a costs, shell out they if it’s probably be a late commission or some other strike against the borrowing. Talking about credit poison, and we’ll find them as soon as we would our examine before last acceptance of one’s financial. Your own home loan try a continuously altering matter that really must be tracked. Do not let an adverse expenses help you stay from your fantasy household!

We have they. You will be getting into your new home therefore want everything you prepared to move in. Usually do not do it! Although you’re going to get the best deal actually ever by filling in a charge card to buy your chairs and you can appliances, significantly more loans is much more personal debt! You ought to maintain your Obligations so you’re able to Income Proportion while the reduced you could regarding the application processes. Whether or not it changes appreciably we have to reassess your credit rating and it may apply to one last app.

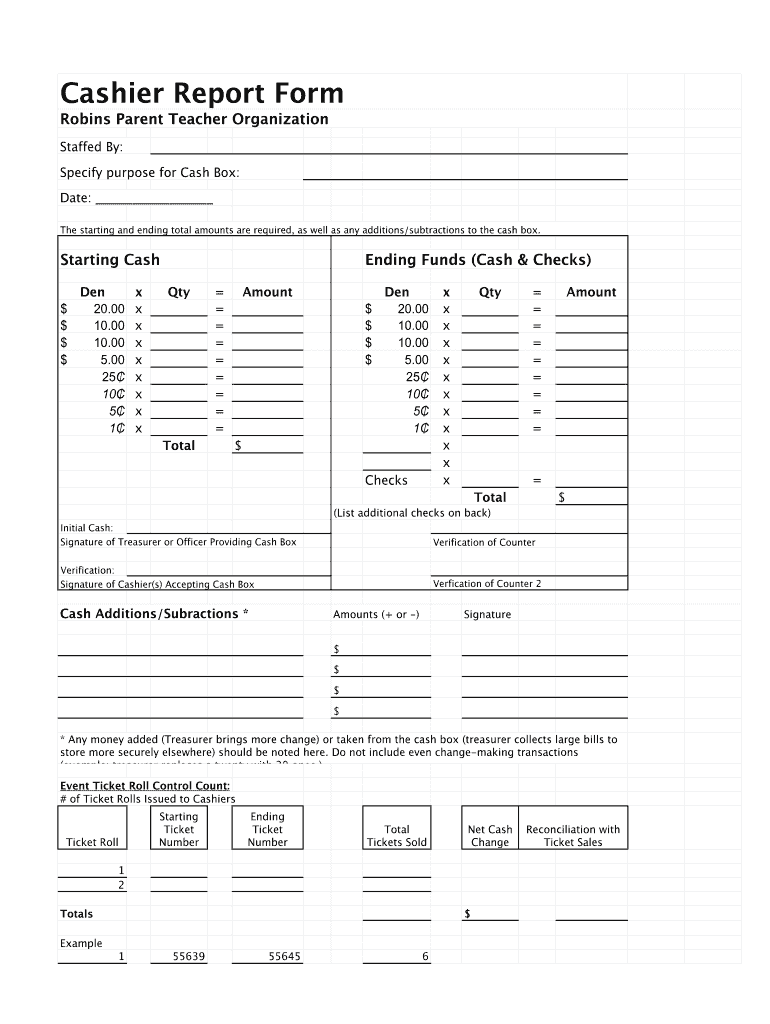

Fill out Your own Present Documentation

Of a lot mothers offer a gift to their students and come up with their basic advance payment on the belongings. Although not, this is certainly a secured asset that might be signed and you may taxed safely. There are more legislation based on how the down payments for every single variety of loan may be used.

Antique

- For individuals who establish 20% or more, it can be away from a gift.

- For people who lay out lower than 20%, the main money are going to be something special, however, part have to come from your money. Which minimum contribution may differ from the financing style of.

FHA and you will Va

Should your credit rating is between 580 and you can 619, about step three.5% of your down-payment need to be your own currency.

In addition, you will need brand new gifter to transmit a present Letter a page outlining that cash is something special and not that loan. You really need to have them to is:

- The newest donor’s term, target and phone number

- The brand new donor’s relationship to the consumer

- The brand new money level of brand new current

- The fresh new day the amount of money was basically transferred

- An announcement regarding donor you to definitely no repayment is expected

- This new donor’s trademark

- The brand new target of the house being bought

Mortgage enterprises would like to know in which your money originates from, so they really know if you have got any expenses that will not appear on your credit score.

Remain Documentation The Places

If you get any money you ought to make sure it is reported thoroughly. For those who offer the car, receive a heredity, or winnings the new lottery, which is great! not, it should be noted securely. For individuals who sell a car, needed at the very least the brand new report from sale. Having the ad your used to sell together with Kelly Bluish Book to show the benefits dont damage, sometimes. For those who obtained a cost off a vintage loans, the cancelled have a look at may be adequate, otherwise a letter on payer may be needed. If for example the team doesn’t create direct put americash loans Kennedy, be prepared to tell you have a look at stubs for the paychecks. Why is it very important? Since your financial really wants to discover without a doubt just what that cash was. When it is a loan, they’ll read. You need to be sincere, once the concealing a loan from your bank is actually fraud.