Continue Borrowing Use within Evaluate

Borrowing from the bank application is when far credit you utilize vs. the credit restrictions. Should your playing cards is maxed away or if you hold larger stability, which is high usage, which reduces your credit rating. You’ll end up surprised during the how fast your credit score improves once the you pay balance down and sustain them there.

Features a combination of Credit

The financing revealing organizations want to see different varieties of borrowing in your declaration. And then make costs into the a car loan or consumer loan shows that you could potentially perform obligations that is harder than playing cards. It is not the biggest factor that determines your credit rating but it is part of it.

Monitor Your progress

View your credit rating to evaluate the impact of responsible personal debt administration. It is good determination to focus to the further improvements. Really credit card providers and banks bring free credit recording, with credit history reputation normally because the each week. Rating free credit reports on annualcreditreport and look that everything is specific. If it’s not, stick to the information and work out corrections, that improve your rating.

Not only are you able to borrow funds to buy, create or renovate a house, however, there are also two kinds of refinancing fund. When you’re qualified because of your military provider, or the wife or husband’s, you can be eligible for some of the available Va loans even after that have bad credit. However,, as usual, affairs together with your money, a position, financial obligation, and you may financial history will establish whenever you can get that loan and you can what its conditions might possibly be.

Virtual assistant purchase funds and several refinancing finance do not require advance payment, closing costs otherwise individual mortgage insurance, but most individuals pay a financing payment ranging from step 1.dos5%-dos.15% due to their earliest Virtual assistant mortgage, and 1.25%-3.3% for after that fund. The higher deposit this new debtor helps make, the low brand new investment percentage.

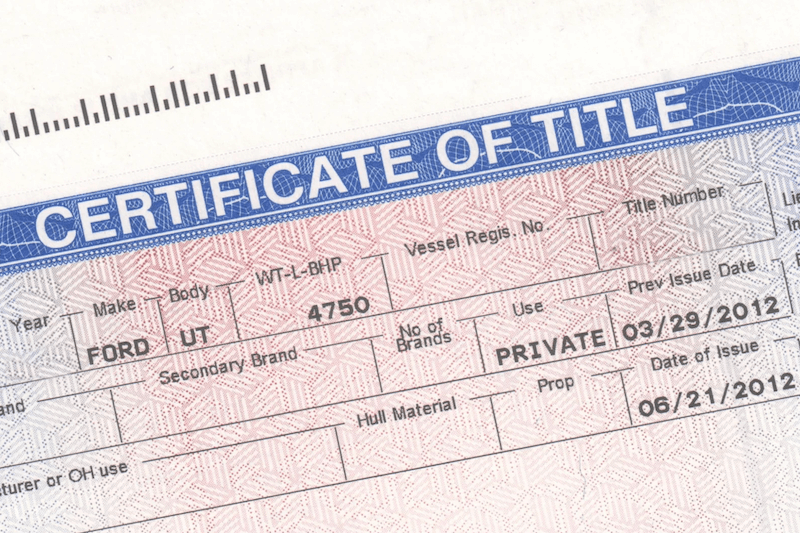

For everybody Va finance, step one is to find a certificate away from qualifications, which ultimately shows loan providers you qualify for the program and you can just what the entitlement are.

Virtual assistant purchase fund is actually supported by the new Virtual assistant with no off payment, settlement costs otherwise personal financial insurance rates, one thing required for individuals regarding traditional funds exactly who lay out quicker than just 20%. The new Va promises the mortgage up to $144,000 then having 25% out of whatever’s lent a lot more than you to. The fresh funds come from private loan providers and can be used to get, build, otherwise raise a property.

Va Dollars-Away Refinance Loans

VA-recognized dollars-aside re-finance finance may be used exchange a low-Va financing or even to simply take cash-out of your equity on the a house to use for debt consolidation, household repairs, or other things the newest debtor desires. The latest debtor need are now living in your house they truly are using mortgage out on. You will find settlement costs for some borrowers, which is paid down at the closing or folded into loan and you will paid off monthly.

Va Rate of interest Cures Refinance Fund (IRRRLs)

Individuals whom currently have a beneficial Va loan and would like to eliminate the monthly mortgage repayment can also be refinance that have a Va IRRRL. Its an alternate loan you to substitute the modern that. Consumers have to have made for the-go out money on their most recent loan towards earlier 1 year so you can qualify. There isn’t any assessment otherwise money confirmation required, and you can closing costs is going to be rolled on the mortgage.

Va Local Western Direct Financing (NADL)

Pros who’re Local Americans, otherwise , that gives loans to acquire, build, otherwise raise a property towards the government believe house. NADLs can be refinanced from system to minimize his response the newest interest rate. There are standards particular towards the financing, also tribal contract with the Va. Read the VA’s website to find out if you be considered.

Residual income

Every application getting yet another line of credit mode an arduous pull on your credit report. The three credit reporting bureaus merely make it a certain amount of difficult pulls just before they decrease your credit rating.