What exactly do each of them imply? When you’re impact baffled, you aren’t by yourself. We now have assembled a preliminary and you can nice reason regarding 10 tech terms you must know one which just lock off your property mortgage.

An excellent redraw studio allows you to accessibility the other payments you create to your home loan. By making additional costs towards financing, you might be reducing the principal amount borrowed plus the number of great interest you have to pay on your mortgage. It is a good option if you were to think you should have more funds after you’ve found your own minimum payment obligations. Its titled a good redraw studio since payday loan Collinsville your currency isn’t closed out. If you would like simply take all of your cash back, you could potentially step one . Recall particular redraw institution will be subject to charge and you can a short wait a little for your finances.

You can decide what portion of your property loan costs should be recharged at the a predetermined rate, and you may just what part often vary with field interest levels (variable)

A counterbalance membership are a transaction membership pertaining to your property loan. Its titled an offset membership as it ‘offsets’ your home loan equilibrium every single day, definition you’re just repaying interest towards difference in your prominent mortgage and also the equilibrium on the counterbalance account. Such a typical bank account, you can put their paycheck and use your bank account to expend costs or make purchases when you need certainly to.

A variable price financial decorative mirrors field interest levels

Lenders’ Home loan Insurance coverage (or LMI) is insurance coverage banking companies sign up for to guard up against the risk of perhaps not curing a complete financing equilibrium for many who (the customer) standard on your own mortgage otherwise getting broke. Banking companies often normally use LMI in the event the LVR calculation try significantly more than 80%. The purchase price is actually passed away for your requirements within the a-one-away from premium, calculated as a percentage of your amount borrowed. It’s advisable that you just remember that , it insurance coverage handles banking institutions not you even when you may be purchasing they. Thus stay away from LMI whenever you can!

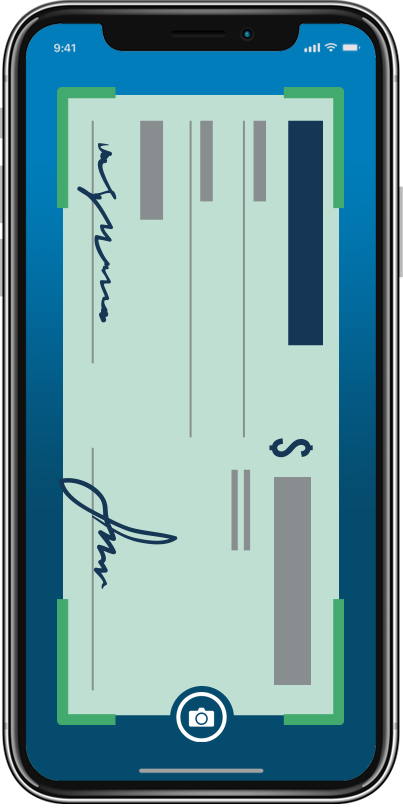

Payment is the judge process in which you get to be the the brand new property owner. The process is addressed because of the funds representative (constantly your own solicitor otherwise conveyancer) and often takes anywhere between 31 and you may 90 days. Toward payment go out, essentially your agent fits to your seller’s agents to help you finalise the fresh new files and you may spend the money for outstanding harmony into the possessions.

An evaluation rate stands for the actual price of your residence financing, since it situations in all the expenses associated with the the loan. It’s built to enable you to contrast lenders and watch hence is about to ask you for less. The new investigations speed is mostly in accordance with the rate of interest, but it addittionally considers the total amount you are credit, how frequently you’re making payments and the big date it will require to blow the mortgage right back.

A fixed rates financial has an interest price which is repaired to have a particular time, typically to five years. It means you will know exactly what your month-to-month repayments would be and you also will not be impacted by rate of interest change. As the interest rates rise and you may slip, very analysis costs. One another choice has their advantages and disadvantages, it all depends about precisely how far balances you desire.

A torn mortgage brings together the protection away from a predetermined notice rate, to the independence regarding a changeable interest rate. Basically, a torn home loan breaks the loan into the two fold repaired and adjustable. Should this be advisable for you, you may find our home Financing Financial Calculator beneficial.