Find out about trick business services and you may knowledge to own financing processors.

If you’ve ever removed financing of any sort, you’ve caused a loyal economic elite group called a loan processor chip — perhaps without realizing it! But what precisely do that loan processor chip create? And could this job community getting a good fit to you?

Regardless if you are a skilled home loan elite trying to find a difference otherwise the fresh for the financial business, listed below are some exactly what you need to learn about this new part, several of good use experiences, and lots of of your simple conditions for a financial loan control job path.

What is actually a mortgage loan Processor Accountable for Undertaking?

A mortgage loan chip (LP) ‘s the middleman involving the lender and also the debtor. They enjoy an option role for the at the rear of loan applications along the finishing line. Let me reveal a closer look at its typical workflow, all of the time:

An interest rate Processor’s Employment: Upon Software

Whenever a home loan software will come in, new processor will start preparing it into the underwriter. Underwriters are household finance professionals who be sure debtor recommendations that assist determine whether they are approved towards financing. Thus, safe to express website subscribers want to place their utmost feet pass. That’s where this new processor is available in.

The brand new LP comes with the essential part away from making certain that brand new debtor provides most of the requisite documents, and additionally income advice, a career confirmation, lender statements, and more. They after that try to ensure all that information. This may were research such as for instance checking on the fresh new borrower’s work status and you may verifying their societal cover amount.

The work also includes organizing the fresh new borrower’s information therefore the underwriter can merely come across and you may accessibility the required files. Inside the this, capable render a clear and you may uniform tale towards the underwriter towards borrower’s earnings, expenditures, address, credit rating, plus.

A mortgage Processor’s Jobs: From the Recognition Procedure

As approval techniques progresses, brand new LP acts as a chance-anywhere between toward borrower and financial. They will certainly follow through on the one demands from the underwriter for additional advice, offer borrower grounds, and you can locate people lost documents.

This new LP as well as instructions all of the 3rd-people services, off name so you can appraisals, and you will assurances every parties work together employing bit of the fresh deal mystery, all in time for a delicate closure.

A mortgage Processor’s Occupations: Closure and you may Past

Since finally acceptance is actually supplied, the fresh LP upcoming works closely with https://paydayloanalabama.com/coats-bend/ this new label company so you’re able to facilitate the new balancing of your finally number. Nonetheless they try to agenda the official closure when the debtor signs on dotted range and home theoretically becomes theirs.

At this point, new LP’s efforts are fundamentally done! They are going to start the complete procedure once more with a new visitors.

What Feel You are going to a processor chip Desire?

Like any field, some skills much more suited to mortgage loan control than the others. That said, there is absolutely no need you simply cannot develop or cultivate the relevant skills required to succeed.

Focus on outline. LPs juggle many customers, data files, and you may facts. They cannot manage to have some thing fall from the cracks. Anyway, even one mistake you certainly will sacrifice the entire offer!

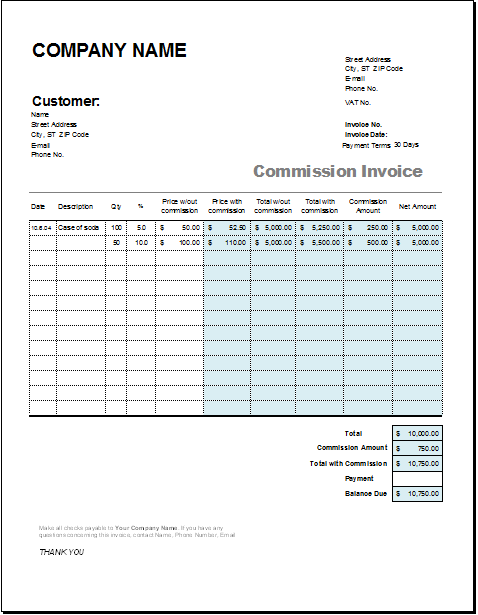

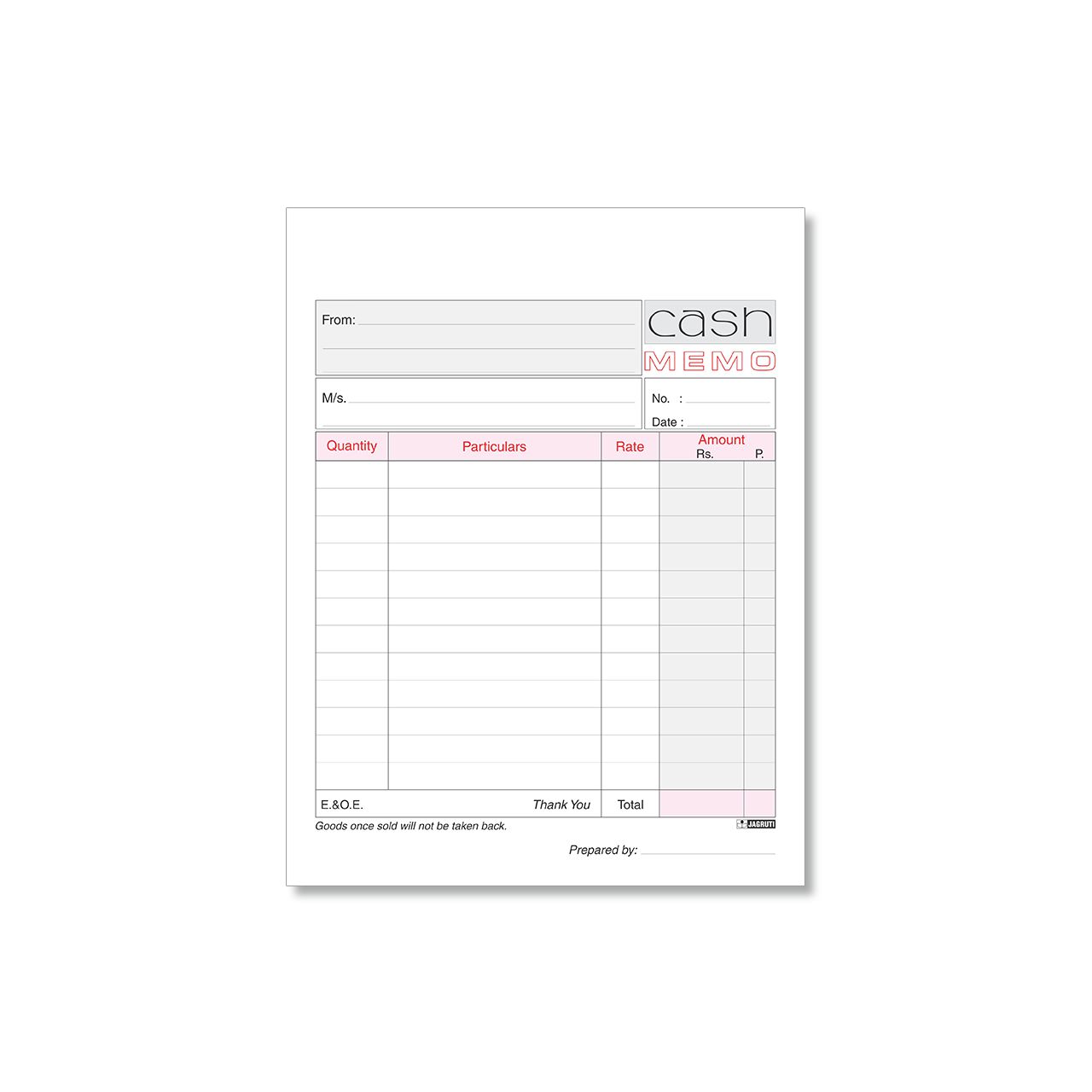

A leading degree of providers. LPs work with multiple file products and would interaction out of numerous stakeholders throughout the day, every day. A strong filing system, an easy-to-use dashboard, otherwise high note-taking results will help keep LPs organized and on song.

Advanced telecommunications. To achieve that it job, you want good telecommunications knowledge, in both creating and you will verbally. Contemplate, LPs try fundamentally middlemen! You’re going to be into the constant connection with several customers, mortgage originators, and underwriters.

Definitely, there are plenty even more characteristics that might give you a great real estate loan processor chip. This type of merely give a bouncing-from section.

When you are desperate to learn more, perhaps consider easy-to-have fun with dash which have or shadowing a region processor. You will see just how the personality gels on occupations and you can let determine if it job is a fit for your, as well.

Any kind of Knowledge or Knowledge Standards?

Mortgage processors will likely you prefer a senior high school diploma, and many companies might need an excellent bachelor’s education in the an area for example funds otherwise bookkeeping. Education degree applications come, but many employers also offer towards-the-work knowledge.

Of several mortgage processors may start out-of just like the financing officer assistants otherwise financing processing assistants to achieve experience, however, expertise in any a portion of the transaction process is beneficial. Including, if perhaps you were a concept organization processor chip or file expert to possess financing maintenance providers, their sense you will change better to mortgage processing.

Willing to Begin Your career given that a mortgage loan Processor?

Thus, do employment for the real estate loan running make sense to you? That it profession is quick-paced however, satisfying, and there’s plenty of room to possess newbies.

Trying have the preferred home loan information lead right to the email? Register for wemlo newsletter and you’ll discover the fresh providers and you can mortgage style all-in-one lay.