Evaluating Borrowing from the bank Unions so you can Conventional Banks

Choosing the right standard bank is very important, because at the conclusion of the afternoon, visitors wishes an effective financial lover to https://paydayloanalabama.com/white-plains/ hang the hard-made money. , a lot of people usually select anywhere between a bank and you will a cards connection. Even though they may seem similar on the surface, there are a great deal more nuanced differences you to we will proceed through lower than:

Possession

One of the primary differences when considering banks and you can borrowing unions try its possession build. Banks is actually belonging to buyers, that have a goal of producing payouts towards the investors. Supervision away from corporate financial operations emerges from the a panel from Administrators exactly who lead the bank on the earnings. As well, borrowing from the bank unions are not-for-cash monetary cooperatives and you may belonging to its people. That usually ensures that borrowing unions provide cheaper financial choice, better prices for the discounts, premium support and you may solution to their users — that in addition to the investors and are supporting of its local teams. Borrowing from the bank Unions is furthermore influenced by the a panel from Directors, but they are opted for by borrowing union members. Which examine off ownership and governance regarding banking companies instead of borrowing unions usually causes a better, even more customized banking feel of borrowing unions.

Banking Activities

Nowadays, really borrowing from the bank unions offer every exact same services and products since their banking equivalents. But not, they normally are confronted with large costs on the discounts profile minimizing prices on the loans.

Rates

As mentioned, credit unions usually bring straight down rates of interest toward finance, than conventional finance companies. Why does that work? Once the borrowing unions is low-profit, they frequently grab the profits’ produced by their products and rehearse these to bring reduced rates. This might be one of the main aggressive pros one credit unions have over conventional financial institutions.

Banking Charges

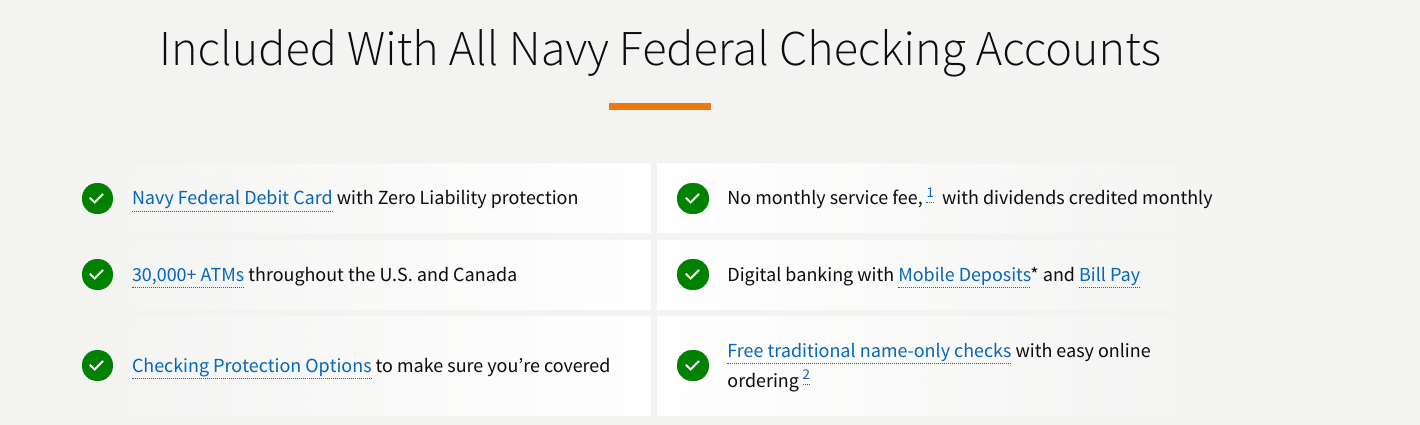

Due to the fact borrowing unions exists to aid the professionals thrive financially, they are going to generally offer quicker charges due to their users, and additionally totally free properties in some instances. Conventional banks routinely have some sort of commission of this the account unless you fulfill a couple of criteria, like lowest balance conditions, and often costs large charges to possess well-known banking mistakes such as for instance shortage of loans, owing to monitors, avoid repayments, an such like.

Customer service

That have a mission concerned about support their members, borrowing unions typically provides an advantage when it comes to provider and service. Once you name a credit connection, you are going to keep in touch with an individual who life and you will really works on your community, in place of an area or offshore call centre you to conventional banks will get fool around with, to enable them to most useful understand your specific demands.

Common Access

Very borrowing from the bank unions was hyper-surrounding, if you get-out out of state, or travel from your own urban area, you may also dump the ability to yourself see a branch of credit commitment. Bigger banking institutions will often have branches and you may ATMs located in most top cities. However,, very borrowing unions take part in a system away from surcharge-100 % free ATMs, as much as fifty,000+ and increasing, along with mutual branching opportunities. Mutual branching lets credit connection members the capability to head to a different borrowing union in the system so you’re able to techniques banking transactions. As well as, into the extension out of digital financial and you may adoption away from technical of the extremely borrowing from the bank unions, banking which have a card commitment can be done no matter where your home is, move or take a trip.

Selecting the right Banking Lover

Typically credit unions lacked some of the mobile and you may tech has the conventional finance companies given. But not, that’s not any longer the situation. Really Borrowing Unions has actually a complete suite from online and mobile banking services, together with virtual account beginning, plus, just like their financial counterparts. Thus don’t allow the fear out of hassle prevent your, extremely credit unions are really easy to accessibility.