You.S. Mortgage Insurers (USMI) has just put-out a study reflecting how MI facilitate connection the off payment pit in the united states and you will promotes homeownership. Notably, brand new declaration confirmed just what is definitely identified: MI makes it much simpler having creditworthy individuals that have minimal off repayments to get into traditional home loan borrowing. Specifically, the report receive:

Because the earliest-big date homebuyers believe using fascinating plunge to your homeownership, it’s important so they can completely understand all home loan options available on the market

- MI possess assisted nearly 30 million family members nationwide purchase otherwise re-finance a home during the last 60 many years

- When you look at the 2017 by yourself, MI helped several mil individuals buy otherwise refinance a beneficial household

- Of the overall 2017 number, 56 per cent from buy fund went along to basic-day homebuyers and most 40 % ones individuals got yearly profits less than $75,000, hence further shows that MI serves middle-money houses

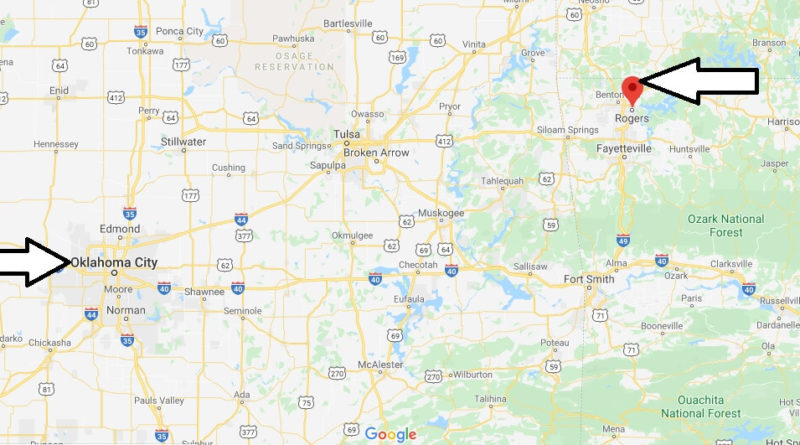

- At condition peak, Texas ranks first in terms of just how many homeowners (79,030) who have been in a position to purchase otherwise re-finance a home which have MI from inside the 2017. It was followed closely by Ca (72,938), Florida (69,827), Illinois (47,866), and you can Michigan (41,810)

Data reveal that today many People in america is using more of their earnings into the book than simply he’s with the mortgage payments. Out of 1985 to help you 2000, the fresh display of income spent on mortgage payments is actually 21 percent; into the Q2 2018 it actually was 18 percent. However, away from 1985 to help you 2000 the new share of income allocated to book is slightly highest on twenty six per cent and contains risen up to twenty eight per cent by Q2 2018. As many individuals and families seek out result in the step off renting so you’re able to getting their own home to manage higher balance and you can create much time-label equity, it’s important why these people have wise low-down fee possibilities such as for example private MI readily available for their coming homeownership needs.

Of your version of lenders readily available, old-fashioned money which have personal financial insurance policies (MI) be noticed as one of the most competitive and you may reasonable routes to homeownership

In addition to the money creation you to definitely homeownership fosters, the present over the years reasonable financial interest rates are a good need so you can pick a home now. Over the course of nearly thirty five decades, the newest housing marketplace has experienced an amazing decline in mortgage interest cost. Inside the 1981, the typical price for a thirty-12 months fixed-price home loan stood in excess of 18 per cent; it endured at the approximately cuatro.72 percent after . Individuals is always to benefit from this type of over the years reasonable mortgage interest rates just like the casing money positives forecast this particular interest decline try over, and primary home loan prices are on an upswing.

Homebuyers shouldn’t take a seat on the brand new sidelines and place out-of buying the family of its goals simply because they are not regarding the condition to put 20 percent down. Because 1957, MI keeps aided millions of Us citizens such as for instance basic-go out homebuyers do well home owners, and it’ll will always be a first step toward the latest construction industry and you may a source to possess borrowers regarding many years to come.

() Individual home loan insurance (MI) aided just as much as 740,000 people inside the 2015, an over 18 per cent increase more 2014, U.S. Home loan Insurance agencies (USMI) today established in conjunction with National Homeownership Day. It development decorative mirrors the good federal pattern indicating overall home loan borrowing from the bank interacting with a four-season highest.

While we celebrate Homeownership Day, USMI is actually proud you to definitely private financial insurance is a significant part of mortgage funds system you to definitely helped so much more consumers getting home owners this past year said Lindsey Johnson, USMI Chairman and you may Exec Director. MI is a great option to let consumers target higher off fee standards, and that is one of the biggest obstacles to cashadvanceamerica.net payday loans without checking account requirements help you homeownership. Consumers should know about the selection, like the benefits associated with MI, prior to making one of the most significant economic decisions of its lifestyle.