Brand new FHA You to-Date Romantic financial allows even very first-date home buyers the ability to keeps a home built to their requisite as opposed to wanting ideal assets on housing market. However, which ones?

Construction Finance aren’t of these on the go; it requires time for you to find the agreements for your home, see a creator (you are needed to get a builder as opposed to becoming your contractor) and have the really works complete. If you would like a home Today, it can be far better imagine buying the brand new design otherwise established design attributes which might be currently accomplished.

FHA You to-Big date Personal build loans are great for consumers who aren’t worried in the having the ability to be eligible for the house loan with the Credit scores.

As a whole, performing lenders could have high borrowing from the bank requirements having build finance than for present build mortgage loans. Be sure to inquire the lender what FICO score range is appropriate for strengthening your property your self lot.

FHA design funds can be extremely ideal for individuals who want a specific style of construction—you might find the style, the materials, the latest products, an such like.

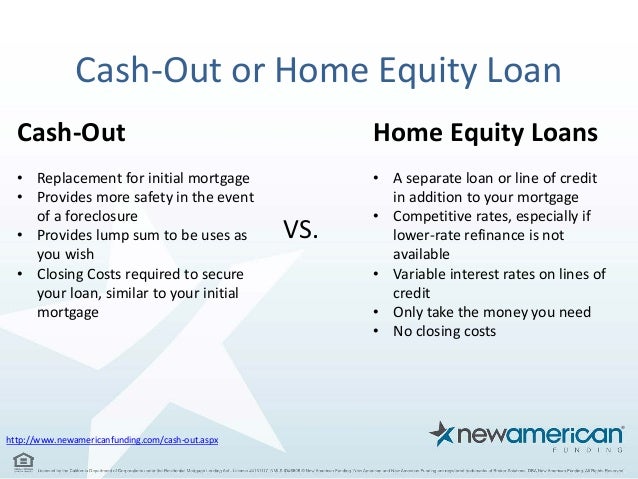

Know that the money you have made in the mortgage isnt believed cash-out and certainly will only be used for approved intentions related in person having the construction of the property

A houses financing need thought; you and your financial will work to one another so you’re able to package the loan and additionally creating an escrow make up the cash you are going to have to pay contractors, pick materials, etcetera. You cannot make use of these finance to many other aim.

If you opt to make in lieu of to invest in a current family, make sure to talk about the time of home loan repayments that have your loan officer. There was your own monthly premiums is almost certainly not owed up until the construction stage is over.

Your financing continue to be required to be paid from into the term of your financing—when you get a thirty year loan and also you dont make a great hypothetical homeloan payment until six months later, you still need to pay off the entire mortgage for the title of loan and not the definition of of your own loan as well as six months.

But when you are interested in certain property diets instance because little land, barndominiums, cottage property or shipments container homes you will need to lookup in other places since FHA One to-Time Intimate mortgage can’t be accepted to possess for example purchases

Pose a question to your lender exactly what means is the best to avoid surprises later on the later on regarding your final incentives count, changes in their monthly mortgage responsibility, etc.

I have over comprehensive lookup toward FHA (Federal Houses Administration), this new Va (Agency from Experts Affairs) additionally the USDA (Us Service out of Farming) One-Time Close Structure loan software. You will find verbal directly to authorized loan providers one originate this type of residential mortgage models in the most common claims and every company provides offered all of us the guidelines for their products. We can link your that have real estate loan officers who work getting lenders you to definitely be aware of the product better and get continuously offered high quality solution. While you are wanting getting contacted of the a licensed bank close by, excite send answers to your questions lower than. Most of the info is addressed confidentially.

FHA will bring recommendations and you will links consumers so you’re able to accredited You to-Day Personal lenders in order to improve feel about it financing product also to let customers discovered high quality provider. We’re not paid for endorsing otherwise indicating the lenders or loan originators and don’t if you don’t take advantage online payday loan Connecticut of this. Customers should go shopping for home loan qualities and you may contrast the solutions in advance of agreeing so you’re able to just do it.

Please note that investor guidelines for the FHA, VA, and USDA One-Time Close Construction Program only allows for single family dwellings (1 unit) and NOT for multi-family units (no duplexes, triplexes or fourplexes). In addition, the following homes/building styles are not allowed under these programs: Kit Homes, Barndominiums, Log Cabin Homes, Shipping Container Homes, Stilt Homes, Solar (only) or Wind Powered (only) Homes.