Every single business has to expand and you may an enthusiastic infusion of cash facilitate the organization move forward in the an optimistic means. Loans are a great way to finance the development and you may the associated expenses. Yet not, there are particular extremely important items this should consider before applying to have like funds.

Making an application for a business mortgage is not always an intricate procedure, but, best arrangements make sure that your chance of achievement. Pursuing the particular tips and you will opting for a loan provider one targets SMEs renders your business financing easy. There are many lenders whom render SMEs which have brief and easy access to the right financing because of their providers. Check today for people who be eligible for timely financing-

That is the first question you are going to deal with, thus ready your effect ahead. It’s important to to learn about your you need and you can ultimate utilisation of the loan. Business loans can be used for numerous purposes — it could be the acquisition of collection, gizmos, provides or seats or for working-capital. The rationale about the loan will pick the nature regarding financing offered and financial institutions which might be ready to give you support.

It is important to mull over the financial loans available to Indian SMEs and discover your best option for your business. You can try national and you will regional financial institutions, borrowing unions, and you will non-profit mini-lenders. These lenders render company personal lines of credit, business fund, and also unsecured loans.

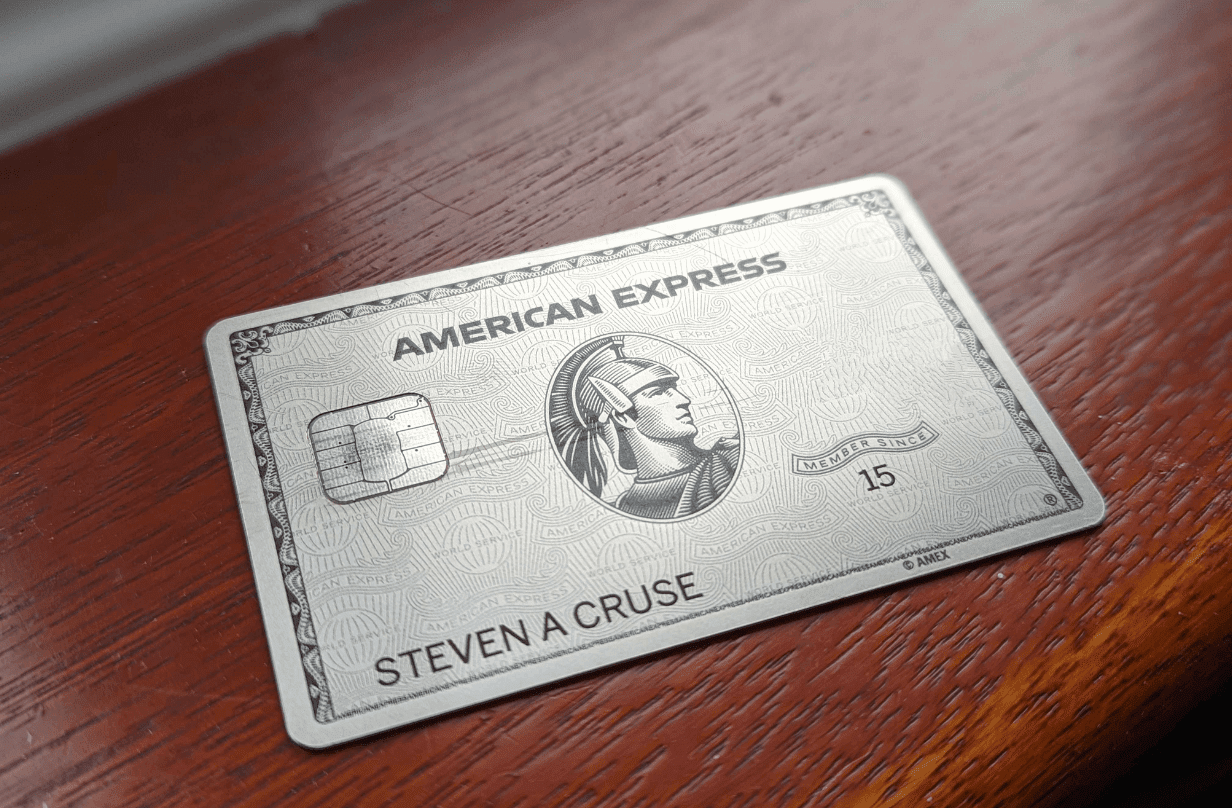

Other choices and personal loans, crowd-financing, and you may company credit cards can be an intelligent choice because the the applying is simple, and the contract tends to be punctual and you can issues-totally free.

Because the type of financing you might need is determined, the next phase is to sort out if for example the qualification to own a corporate mortgage. Most banks, and people providing loans, trust the non-public credit of one’s business person(s) when designing conclusion.

Your ultimate goal is actually one thing inside the making an application for good company mortgage. You need to have clear tip regarding the in the event the goal is actually to help you spread out to help you the brand new areas otherwise bring a much better product/service towards niche market. Your first step is always to delineate your target.

Once your desires are ready, it is essential to break classify her or him into certain amount you to will assist your meet your own fantasies. Whether your aim is always to target new segments, attempt to begin new mes as well as hire info to market and gives service for the directed field.

Cash is brand new lifeline of every company. Before you apply for a corporate financing, you ought to no upon the amount of money you prefer just like the that loan. To accomplish this you have got to exercise the main city you have to secure the issues necessary to see your online business goals.

It will always be advisable to get ready a corporate plan to investment the period of time where you will need the newest additional monetary support.

Reveal business strategy ‘s the first average out of www.elitecashadvance.com/installment-loans-wa/kingston selling your own attention and you may economic strength for the lender. An effective business plan leaves forward your organization’s story, from the basis so you’re able to its experience of the marketplace. They illustrates your business’ objective and the roadmap to own gaining desires. Financial records promote an entire studies out of exactly what you currently finished along with your coming agreements.

Lenders accept that enterprises submission an extensive business plan has actually a beneficial better possibility to make it and you will spend their financing straight back promptly

Business loans will want extensive paperwork. Loans with finance companies, credit unions, otherwise on line loan providers ask for more information regarding on your own along with your organization. Get ready towards data.

Running times having loans trust the sort of financing together with count expected. While some need weeks or days to possess recognition and you can financing anyone else get back to you per day otherwise a couple.

When you’re denied, learn the cause for the latest unapproved loan and change your chances the very next time. Often you will find ventures offered which match your providers better. Just remember that , each time you apply for that loan a challenging borrowing from the bank inquiry is accomplished, and every inquiry can also be lose your credit rating of the a number of points.

Apart from the antique lenders, you will find a keen emerging pattern towards the bizarre lenders to include team financing so you’re able to SMEs

The way to get better at your chances of bagging a corporate financing would be to invest time in the foundation before submission a credit card applicatoin. If you like help with their credit or cash flow, take needed strategies to cultivate these parts in advance of handling banks. Thoughts is broken convinced regarding the reputation, have a look at business loans to identify the best financial to you personally and you can your company.

Leave A Comment

You must be logged in to post a comment.